- Meyka AI's Newsletter

- Posts

- 2025 Market Recap: Top-Performing Tech Stocks and Solid Metals That Shine

2025 Market Recap: Top-Performing Tech Stocks and Solid Metals That Shine

The real winners of 2025 weren’t loud; they delivered

As of December 31, 2025, global markets are closing one of the most eventful years of the decade. Technology stocks once again shaped investor sentiment. At the same time, metals delivered surprising strength. Artificial intelligence moved from hype to hard spending. Companies built data centers, ordered chips, and signed long-term contracts. This shift changed balance sheets and stock prices.

In the U.S., a small group of tech leaders drove most of the gains. Some stocks soared. Others lagged, even with strong brands. The reasons were clear. Earnings growth mattered. AI exposure mattered more. Big projects and partnerships also changed how investors value future growth.

Metals told a different story. Gold, silver, and copper benefited from rate cuts, global tension, and heavy industrial demand. These assets offered both protection and opportunity.

This newsletter looks back at what truly moved markets in 2025. And we highlight what may matter most as 2026 approaches.

Top 5 U.S. Tech Stocks: 2025 Performance Review

2025 was a strong year for many major U.S. tech stocks. Markets ended the year near record highs on December 31, 2025. The U.S. stock market rose as investors bet on artificial intelligence driving the next phase of growth. The S&P 500 finished up about 17% for the year, led by concentrated gains in leading technology companies.

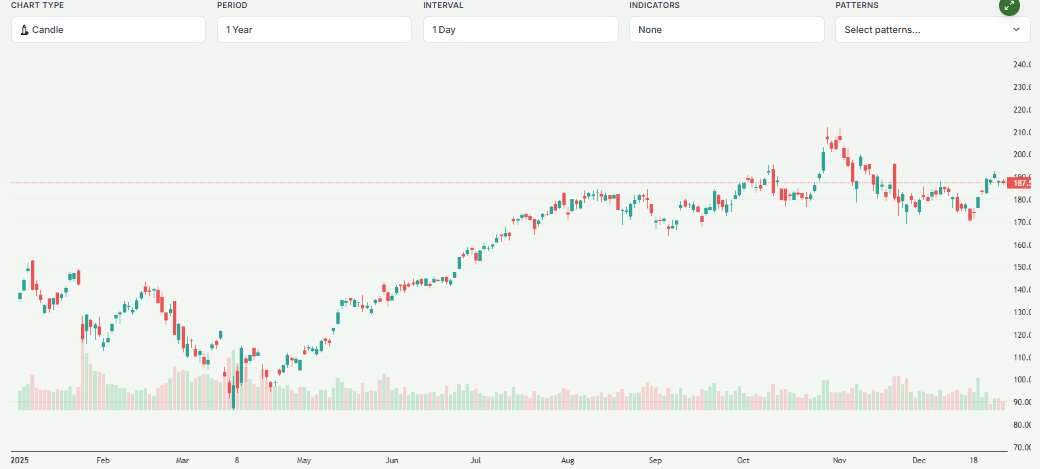

NVIDIA (NVDA)

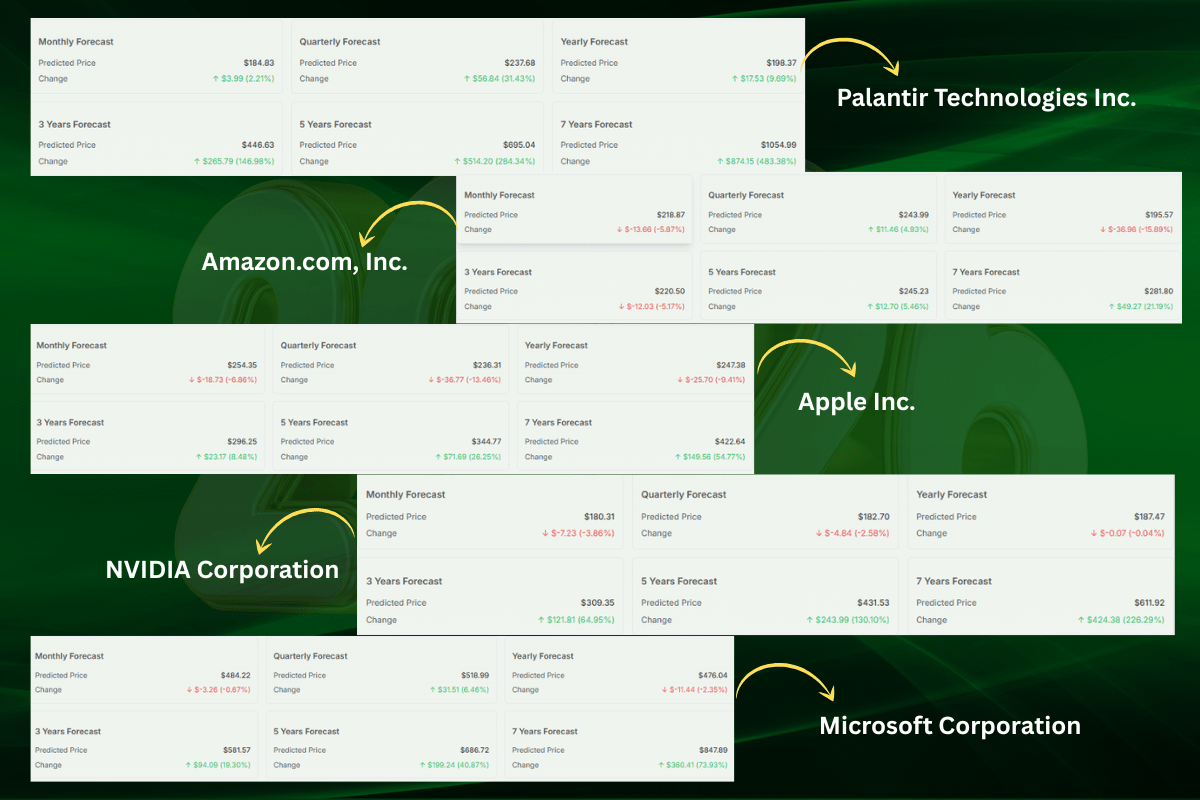

Nvidia’s stock delivered one of the strongest gains among major tech names in 2025. It finished the year up about 39.7% in total return (price + dividends) through December 30, 2025. Its leadership in AI data-center graphics processors and heavy demand for H200 and Blackwell-series chips drove this outperformance.

Meyka AI: NVIDIA Corporation (NVDA) Stock Overview 2025

Microsoft (MSFT):

Microsoft posted a solid gain of roughly 16.5% for the full year 2025, driven by continued growth in Azure cloud and AI-related services. Increased enterprise adoption of AI tools helped sustain its performance relative to peers.

Meyka AI: Microsoft Corporation (MSFT) Stock Overview 2025

Apple (AAPL):

Apple’s stock returned about 9.5% in 2025, relatively modest compared to other tech giants. Strong services revenue and stable product demand helped, but its gains were lower than the broader AI-led tech rally.

Meyka AI: Apple Inc. (AAPL) Stock Overview 2025

Amazon (AMZN):

Amazon’s stock lagged many peers, posting around 6% total gain in 2025. Growth in AWS revenue partly supported the stock, but slower momentum compared with rivals kept overall gains modest.

Meyka AI: Amazon.com, Inc. (AMZN) Stock Overview

Palantir (PLTR):

Palantir was one of the standout performers. Estimates from late 2025 showed its share price up around 140-150% on the year, as demand surged for its AI-powered data analytics platforms in both government and commercial markets.

Meyka AI: Palantir Technologies Inc. (PLTR) Stock Overview 2025

These numbers show clear differences in how investors rewarded each company in 2025, with AI-centric and analytics-focused names outperforming more traditional tech players. The varied returns reflect both individual business strength and broader market rotation toward AI spend and cloud infrastructure.

Why These Stocks Moved in 2025?

Tech gains in 2025 were rooted in AI adoption and cloud computing demand. Businesses and governments increased spending on AI tools and data-center infrastructure. This drove revenue growth for companies tied to computing power and enterprise adoption.

Investor focus shifted toward stocks with clear AI monetization paths. Microsoft’s AI cloud strategy and NVIDIA’s lead in generative AI silicon helped both stocks benefit. Meanwhile, Apple’s slower AI pivot led to more mixed performance. Demand patterns also shifted in favor of enterprise software platforms, helping Palantir‘s growth.

Tariff pressures and trade policy uncertainty added volatility to the broader market. But major tech earnings remained resilient, which helped sustain investor confidence late into the year.

Major Innovation Projects & Partnerships

One of the most talked-about developments in 2025 was the launch and expansion of the Stargate Project. Announced in January 2025, Stargate is a massive AI infrastructure effort that aims to build out next-generation computing resources across the United States.

Stargate was created by OpenAI, SoftBank, Oracle, and MGX to invest up to $500 billion over four years to build AI data centers. The project is designed to strengthen U.S. leadership in artificial intelligence and support large-scale computing needs.

By mid-2025, Stargate partners had already advanced major builds. Oracle and OpenAI agreed to develop 4.5 GW of AI data-center capacity, enough to support millions of GPUs and high-performance compute clusters. This capacity allows frontier AI models to be trained faster and at scale.

Additional data centers were added through partnerships involving SoftBank, corporate sponsors, and regional development efforts. By the end of 2025, Stargate had nearly 7 GW of planned capacity across multiple U.S. sites, pushing toward the 10 GW target well ahead of schedule and creating thousands of jobs in construction and operations.

This project ties deeply into the strategies of leading tech firms. Oracle’s infrastructure deals and cloud growth have been supported by Stargate commitments, while OpenAI benefits from scale and access to massive clusters of AI compute power. NVIDIA’s GPU technology and partnerships are central to building this next-gen compute foundation.

2026 Tech Stocks Outlook

Looking into 2026, many analysts believe AI will continue to influence growth trends:

NVIDIA remains well-positioned due to its strong market share in AI chips. Continued corporate and cloud customer demand could support additional gains, although valuation and global macro risks may moderate upside.

Microsoft is expected to grow as Azure‘s AI services expand and enterprise adoption continues. Its broad customer base and suite of productivity tools, combined with AI enhancements, could help sustain growth.

Apple may see stronger performance if its AI offerings become more integrated across devices and services. Analysts note significant potential as Apple expands beyond hardware into more AI-centric software.

Palantir stands to benefit from rising demand for enterprise AI analytics, especially in defense and government segments. Continued contract wins and platform expansion could support another year of robust gains.

Amazon must leverage AWS AI deployments and cloud innovations to boost investor confidence. Long-term growth may hinge on deeper AI service integration and improved profitability.

Market watchers remain alert to shifts in sentiment. Emerging AI leaders like Tesla and cybersecurity firms also gained attention for 2026 strategies, but core mega-cap tech will likely continue driving market direction.

2025 Metals Recap: What Shined?

Metals produced standout returns in 2025. According to December 31, 2025, market data, silver prices surged about 161%, and gold was up roughly 66% for the year. Industrial metals like copper hit record highs near $12,960 per ton thanks to strong demand from AI data centers, EV charging infrastructure, and renewable energy sectors.

These gains were driven by global demand for industrial metals and sustained interest in precious metals as inflation and monetary policy stayed in focus. Central bank buying and tight supplies also supported higher prices.

2026 Metals Outlook

Precious metals like gold and silver may continue to perform well if interest rates fall and geopolitical risk persists. Industrial metals such as copper could stay supported by global energy transition projects and electrification investments. However, cyclical forces and capacity expansions may temper some gains.

Wrap Up

2025 was a year defined by AI and infrastructure build-outs. Leaders in AI compute and cloud services showed strong performance. Metals offered diversification and protected returns during volatility. Looking ahead into 2026, fundamentals, innovation, and large projects will continue shaping market trends. Strategic positioning across tech and materials sectors could offer growth opportunities in the years ahead.

Frequently Asked Questions (FAQs)

Which tech stocks performed best in 2025?

In 2025, AI-focused tech stocks performed best. Companies linked to chips, data centers, and artificial intelligence demand led gains, especially those showing strong earnings growth by December 31, 2025.

Why did silver and gold rise sharply in 2025?

Silver and gold rose sharply in 2025 due to safe-haven demand, central bank buying, and industrial use. Prices stayed strong through December 31, 2025, during market uncertainty.

Are metals or tech stocks better for 2026 investing?

By late 2025, investors searched for this as both assets performed well. Metals offered stability, while select tech stocks offered growth, making diversification a common strategy for 2026 planning.

Disclaimer