- Meyka AI's Newsletter

- Posts

- Crypto Market Crash Ahead? What October 10 & 13 Reveal About Investor Sentiment

Crypto Market Crash Ahead? What October 10 & 13 Reveal About Investor Sentiment

How Sudden Swings Exposed Cracks in Crypto Confidence

Table of Contents

The Crypto Market Crash fears are back after two wild trading days on October 10 and 13. Bitcoin and other big tokens swung hard, and many traders woke up to steep losses and frantic hedging.

Analysts point to a mix of macro shocks, fast-moving algorithms, and a sudden drop in liquidity as the core causes. For many investors, those two dates were a reminder that crypto moves faster and sometimes harsher than traditional markets.

But what exactly happened on those days, and why are traders suddenly so nervous? Let’s walk through the facts, the sentiment shifts, and the simple steps investors are using to protect portfolios.

Crypto Market Crash, October 10: Early Warning Signs

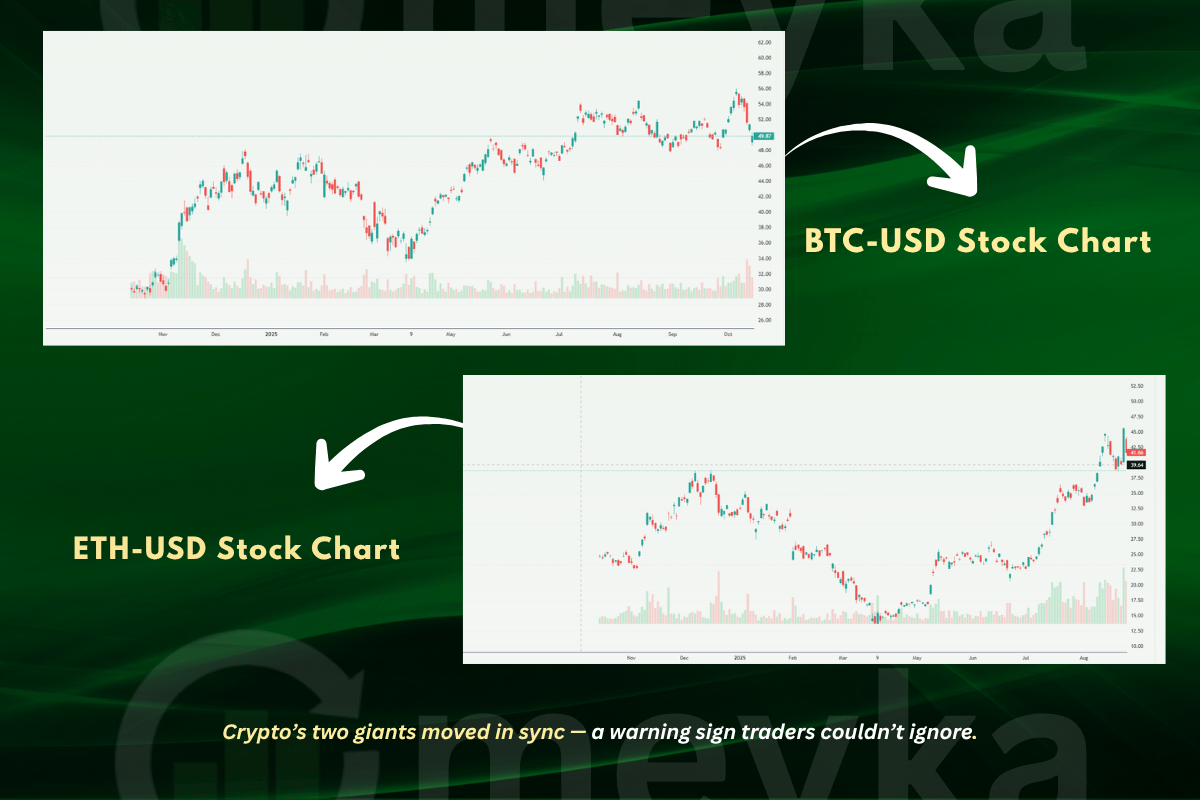

October 10 marked the start of a volatile week. Bitcoin price trends showed a sharp intraday drop, more than a few percent, and that pulled Ethereum volatility and many altcoins down with it. Traders pointed to macro moves (like rising U.S. yields and a firmer dollar) that made risk assets less appealing.

That combination hit crypto hard because the market is still liquidity-sensitive and crowded with leveraged positions.

Why did crypto react so sharply?

Because higher yields and a stronger dollar push cash into safer places. When that happens, speculative bets get repriced quickly. Also, automated trading models can amplify moves: they detect weakness and sell into it, making the drop faster.

AI Stock research and other algorithmic models now link crypto moves more tightly to bond and dollar trends, so short-term correlations can swing very fast.

Crypto Market Crash, October 13: Panic Selling or Smart Hedging?

October 13 deepened the fear. The market saw massive paper losses and heavy liquidations; the options and futures markets showed a sharp flip to put buying and defensive trades. Some reports put the liquidation figures in the billions, and many traders moved into stablecoins and derivatives to hedge. These flows show a clear risk-off mood: people were not just selling crypto, they were buying protection.

Was this a routine correction or a sign of a bigger crash?

Experts differ. Some see a classic sentiment-driven shakeout that clears excess leverage. Others warn that patterns look like earlier tops where optimism turned into rapid selloffs. Either way, the speed of the moves matters more now; it can force selling and make corrections deeper.

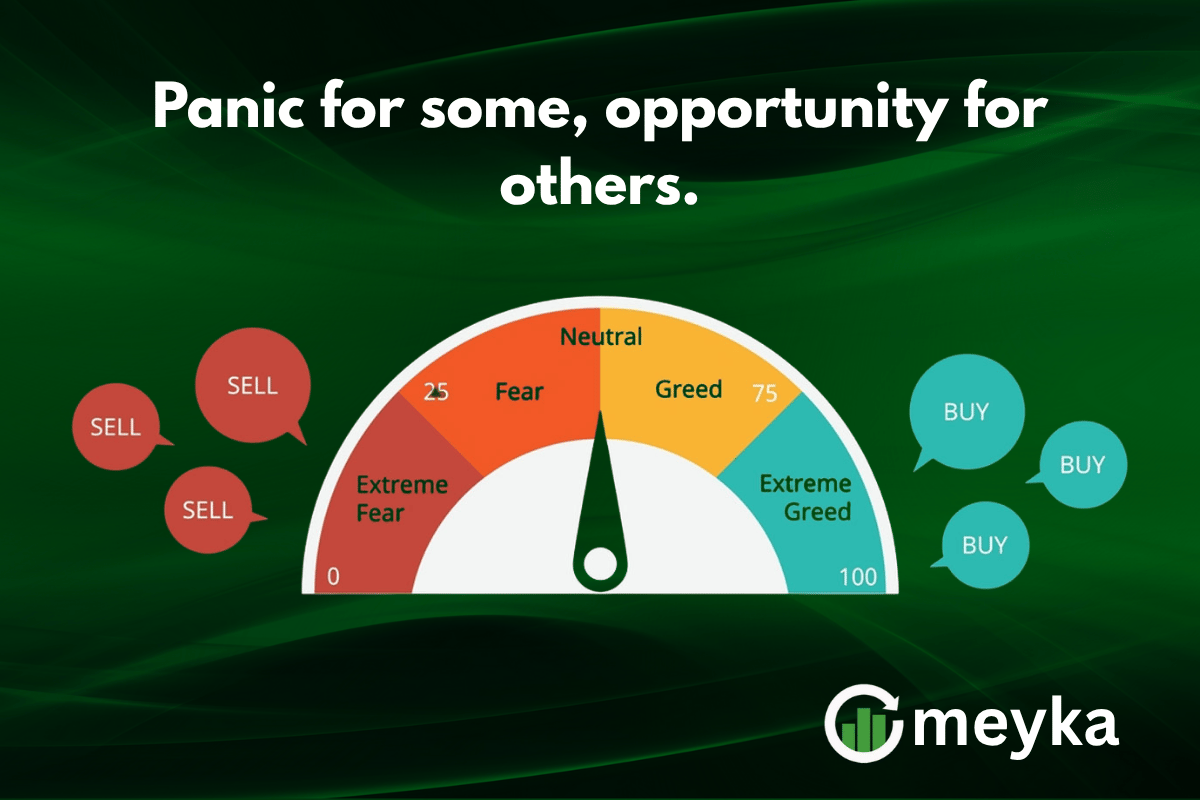

What the Data Says About Crypto Investor Sentiment

On-chain and exchange data tell a similar story: funding rates fell, open interest shrank, and options flows favored puts. These are technical signs that traders pulled back on leverage and bought downside protection. Sentiment trackers flipped from neutral to fear in just a few sessions, a big change in a short time.

AI Stock Analysis models, now used by quant traders and some funds, flag that the current mix of readings resembles pre-correction setups from past years. That doesn’t mean a crash is certain, but it does suggest short-term risk is elevated and trading psychology has shifted toward preservation. (This is an informed inference based on current indicators in the market.)

Analysts’ Views: Warning Signs or a Necessary Market Reset?

Headline takeaways from analysts split two ways. Some warn of a broader digital asset correction driven by macro risk (higher rates, trade tensions, and weaker growth). Others call it a cleaning; leverage is gone, risk has been reset, and healthy capital can return later. Both views are valid: higher volatility can be painful, but it can also set the stage for new, more stable cycles if liquidity returns.

How Investors Are Hedging Against a Possible Crypto Market Crash

Retail and institutional traders are using different tools. Retail investors often shift to stablecoins, reduce position size, or set stop losses. Professional players increase futures hedges, buy puts, or allocate capital into tokenized, less volatile assets. There is also growing interest in crypto hedge strategies that blend spot holdings with derivatives protection.

Note: platforms that combine blockchain data with AI tools, including some that track AI Stock trends, have seen more use as traders hunt for real-time insights. These tools don’t remove risk, but they help identify where liquidity and sentiment are shifting. Use them as one input, not a single answer.

Lessons from October’s Volatility: A Look Ahead

History shows that volatility spikes often come before major reversals. Sometimes those reversals are the start of a deeper bear run; sometimes they’re a sharp correction followed by a bull continuation.

Right now, Bitcoin's dominance rising suggests capital is consolidating into larger, more liquid assets, a sign of risk-off rotation toward perceived blue-chip crypto. That pattern points to a maturing market, not a failed one, but it also means smaller altcoins remain at high risk.

Should investors stay in or exit now? Experts advise caution, not panic. Diversification, clear stop rules, and a long-term plan often beat emotional trading in choppy markets.

The Broader Picture: Macro + AI = A New Market Dynamic

Two broader trends matter: macro pressure (rates, trade, geopolitics) and the rise of AI-driven trading. AI Stock research and algorithmic strategies now adjust exposure faster than human traders can. That increases short-term correlation across asset classes, so crypto can move with bond yields and dollar flows more tightly than before. At the same time, AI tools can help spot early signs of stress if used carefully.

Conclusion: Read the Signs, Not the Noise

The Crypto Market Crash headline is scary and partly fair. October 10 and 13 showed how quickly sentiment can flip and how fast leverage can be wiped out. But those days also revealed a maturing market where traders hedge, rotate, and use smarter tools.

Whether this is a deeper downturn or a volatile reset depends on macro signals and how liquidity returns. The smart move for most investors is clear: limit leverage, diversify, and keep a long-term view. In short, informed decisions and patience still matter most.

FAQs

Why did the crypto market crash in October 2025?

The crypto market crash around October 10 and 13 was triggered by a mix of rising U.S. Treasury yields, a stronger dollar, and profit-taking after recent rallies. These macro factors pushed traders to reduce risk exposure, causing Bitcoin and other major tokens to drop sharply.

Is this crypto market correction a long-term crash or a short-term dip?

Analysts are divided. Some believe this is a short-term correction similar to past cycles, where fear leads to temporary pullbacks. Others warn that weakening global liquidity could turn it into a longer downturn if macroeconomic conditions don’t improve.

How can investors protect themselves from another crypto market crash?

Investors can hedge risk by diversifying into stablecoins, using futures or options for protection, and avoiding excessive leverage. Monitoring AI Stock Analysis tools and sentiment indicators can also help identify early warning signs before large market swings occur.

Disclaimer: