- Meyka AI's Newsletter

- Posts

- 'Crypto Week' Buzz, Bitcoin Hits $122,500+ High While NVIDIA gains 4% and becomes most valuable again

'Crypto Week' Buzz, Bitcoin Hits $122,500+ High While NVIDIA gains 4% and becomes most valuable again

Bitcoin surges on ETF momentum as NVIDIA reclaims the top spot with AI-fueled gains

Table of Contents

Bitcoin just crossed $122,500, hitting a new all-time high. This happened during one of the most exciting times for crypto: Crypto Week. At the same time, NVIDIA jumped 4%, becoming the most valuable company in the world again. Two big stories from two different markets, crypto and tech, are making headlines this week.

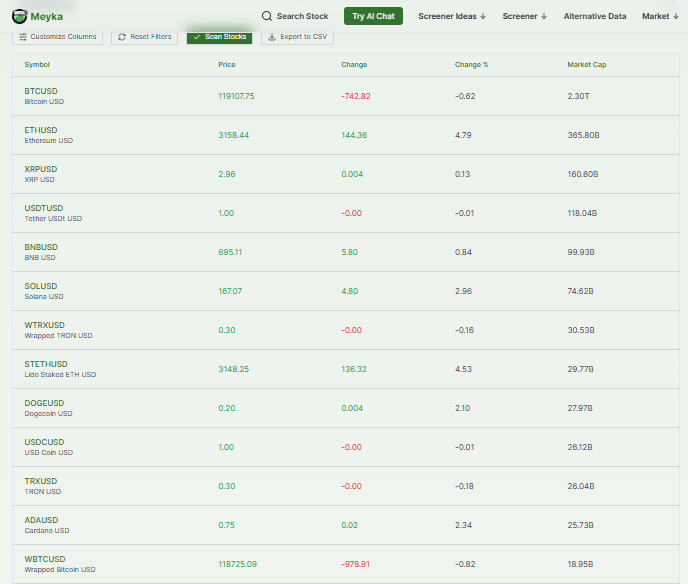

It’s not just a lucky moment. Both are riding strong trends. Bitcoin is getting support from institutional investors and growing excitement around ETFs.But we’re not just seeing Bitcoin rise. Altcoins like Ethereum, Solana, and XRP are also getting ready to make big moves. NVIDIA, on the other hand, is leading the charge in AI technology, powering tools like ChatGPT and many others.

We’re seeing major movements in both crypto and the stock market. It’s the kind of week where investors, analysts, and everyday people are all paying close attention are asking the same question: Is this the start of something bigger?

Let’s uncover what’s happening behind these price jumps. We’ll talk about the reasons, the risks, and what it all means for the future.

Bitcoin’s Surge: Breaking Down the $122,500+ Milestone

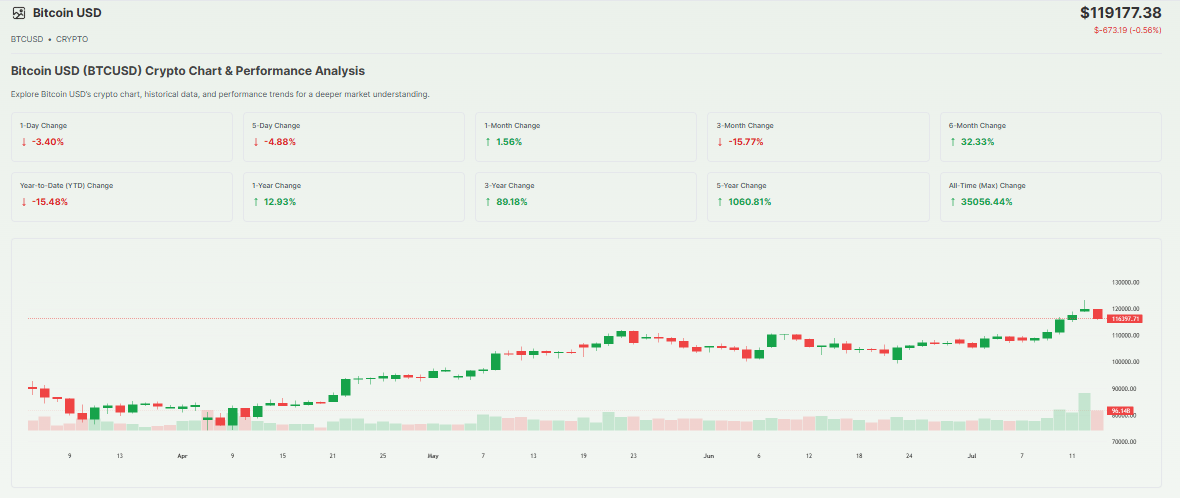

Bitcoin recently hit a jaw-dropping all-time high above $122,500, riding a wave that began earlier in July when it traded around $105,000. That jump is no accident. Investors poured $14.8 billion into U.S. spot Bitcoin ETFs just this year. This marks record inflows and shows strong demand from institutional players.

We’ve also seen heavy buying by big players. Strategy (formerly MicroStrategy) added 4,225 BTC worth $472 million in July alone.

Add all this up, and Bitcoin’s market cap now stands near $2.4 trillion, which makes it the fifth-largest asset worldwide, even eclipsing Amazon.

Still, such a rapid run-up means the price may pause. Indeed, after hitting the high, it dropped briefly to about $118,000 as some traders took profits. That pullback is normal. But with more inflows expected, the next key resistance sits between $125,000 $140,000.

What’s Fueling ‘Crypto Week’ Buzz?

This week in the U.S. House is officially “Crypto Week.” Lawmakers are voting on three major bills:

GENIUS Act (stablecoin rules),

CLARITY Act (crypto framework),

Anti‑CBDC Surveillance State Act (blocking digital dollars).

The momentum comes from lawmakers on both sides, including Rep. Tim Scott and Sen. Cynthia Lummis, who are praising the push for clear crypto rules. Investors' hope for stable rules has opened the floodgates. ETFs have seen $3.7-$14.8 billion in inflows this month.

Plus, political support is coming from the top. President Trump has positioned himself as a “crypto president”, calling for lighter oversight.

NVIDIA’s 4% Surge: AI Strength Powers Its Rise

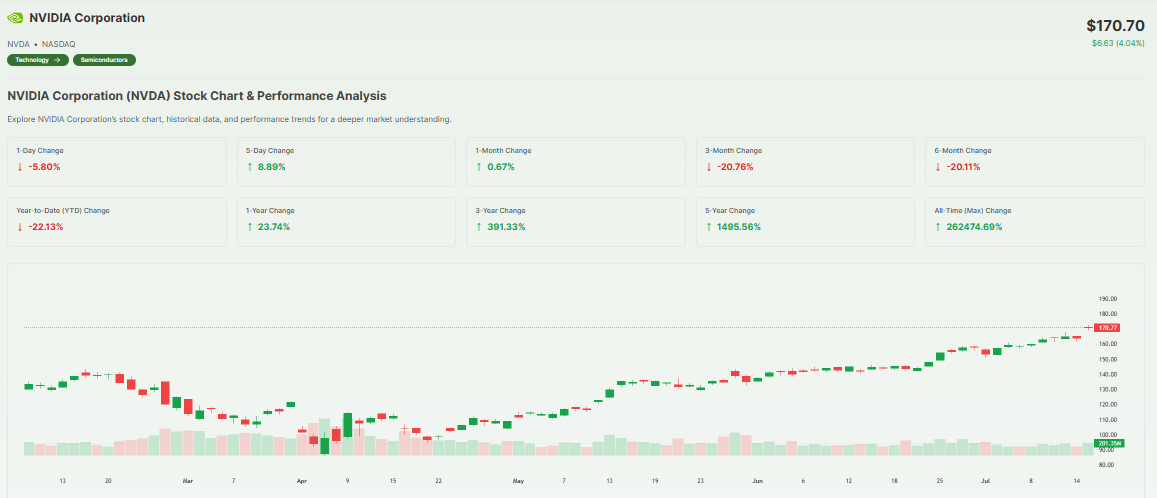

Around the same time, NVIDIA stock soared roughly 4%, closing near $170.70, fueled by news it can once again export its H20 AI chips to China.

The U.S. government approved a more modest version of the H20 chip, often called its “fourth best” for export. This change ends a several-month ban that cost the company up to $8 billion in sales. Restoring China sales opens a key market that brings around $17 billion in annual revenue.

With this rebound, NVIDIA briefly regained the title of the world’s most valuable public company, with its market cap topping $4 trillion. Wall Street firms like Loop Capital are even predicting a run toward $5 trillion, citing booming AI demand and restored China access.

Are Tech and Crypto Booms Linked Again?

We’re watching a growing connection between crypto and tech markets. A January 2025 study found Bitcoin is increasingly tied to Nasdaq and S&P trends, with correlation scores near 0.87. The shared drivers? Liquidity, interest‑rate trends, and the fact that both attract institutional capital.

In 2024-25, both crypto and AI tech have benefited from a “risk-on” shift. Lower inflation and central bank signals of rate cuts have helped prop up both asset classes. We think this link adds extra fuel when both sectors catch a break at once.

Altcoins: Poised or Paused?

While Bitcoin grabbed the headlines, altcoins have not been silent. Ethereum stood out, rising as high as $3,144, gaining over 6% during Bitcoin’s peak. The Altcoin Season Index went above 75 on July 8. It marks when capital starts flowing out of Bitcoin and into other tokens.

Some pulse-check signals:

Still, Bitcoin’s dominance is nearly 64%, so altcoins need deeper rotation to truly run.

Expert Insights & Community Reactions

Market insiders are buzzing. Many analysts are bullish. Loop Capital calls this a “Golden Wave” of AI, raising its price target to $250. IG analyst Tony Sycamore notes Bitcoin is riding “several tailwinds” from policy support to institutional strength. On social media, Charlie Bilello pointed out that Bitcoin’s rise from $290 to over $119,000 in a decade equals 410× growth. On stock forums, NVIDIA believers say this update is a signal that China sales and demand will remain strong.

Expert Insights & Community Reactions

On Reddit and Twitter, traders are split. Some believe Bitcoin could hit $200,000 this year, while others warn the rally could be overbought.

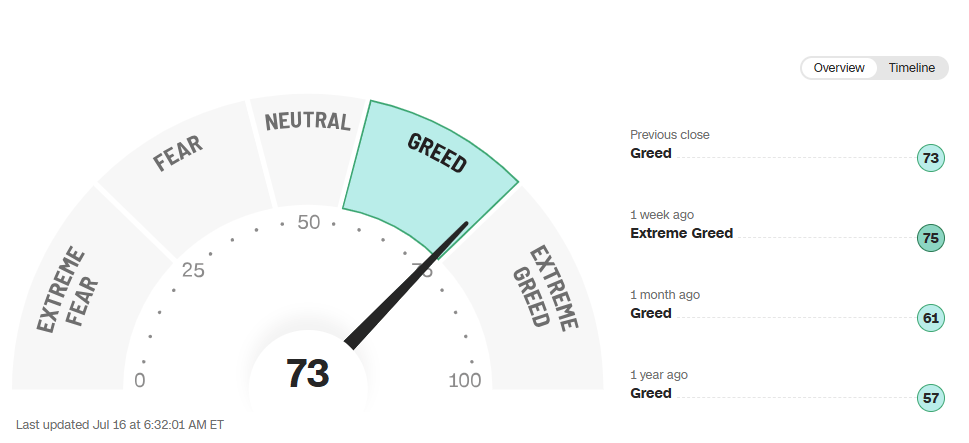

Market indicators show caution, too. The Fear & Greed Index is near 70, meaning greed may be high, and corrections could come.

Risks & Volatility Ahead: What Could Slow Us Down?

As exciting as this week has been, we can’t ignore the risks ahead. Both crypto and tech markets are known for their ups and downs. A few warning signs could shake things up, even momentum is strong..

Crypto Risks

Regulation is still a big question. While new bills in Congress aim to give crypto more clarity, stricter rules may still come. A sudden crackdown or tax policy could push investors away. And let’s not forget that Bitcoin surged so fast that more than $276 million in short positions were liquidated. Fast moves like this often come with sharp corrections.

There’s also pressure from the broader economy. Inflation or tariffs could shake confidence. For example, Trump’s new tariffs on the EU and Mexico may cause global markets to wobble. Some altcoins have already dropped over 10% from recent highs. That tells us crypto can cool off quickly.

Tech Risks

NVIDIA is doing well, but expectations are sky-high. Investors now expect strong earnings every quarter. Even a small miss could hit the stock hard. Yes, China sales are back, but trade risks remain. A new chip ban or a surprise from competitors like AMD could change the story fast.

Right now, NVIDIA trades at about 30× forward earnings, which is below its historical average of 40×. That gives it some room, but not much. Investors need to keep an eye on earnings reports and global chip demand.

What to Watch Next?

Here are the top signs we’ll follow:

Congress votes - if bills pass, more clarity means a possible next leg up.

ETF flows -heavy weekly inflows support further price increases.

Bitcoin dominance (%) - a drop below 60% could spark a full altcoin season.

ETH/BTC ratio - a move above 0.065 confirms real interest in Ethereum and similar projects.

Technical zones - Bitcoin holding above $115-118k signals strength; altcoins must push past key resistance to stay bullish.

What We Think Investors Should Keep in Mind?

The big takeaway? Diversify. We see a powerful week for both Bitcoin and NVIDIA. If you invest in one, consider exposure in the other. Both are riding macro trends like rate moves and global liquidity.

Make sure to watch macro data. Federal Reserve signals, inflation numbers, or global trade shifts can affect both assets rapidly.

Final Words

This week could be a key turning point. Bitcoin soared past $122,500 on strong ETF inflows and fresh policy buzz. NVIDIA bounced back as chip export rules eased.

When crypto and AI rise together, it's a signal to watch. If momentum holds, we may be entering a new bull cycle. If not, some correction or sideways action could follow.

Altcoins are active but need more strength. The coming weeks will shape what’s next, and we’ll be tracking it closely with shifting politics and markets.

Frequently Asked Questions (FAQs)

What is the next big crypto to explode?

Solana, Avalanche, and Chainlink are getting attention. Experts say they have strong tech and growing use. But crypto is risky, and no one can know for sure.

Why is Nvidia suddenly worth so much?

Nvidia’s value jumped because of high demand for its AI chips. Many companies need them for AI tools, which boosted sales and made investors more confident.

How did Nvidia become the most valuable?

Nvidia became the most valuable company by leading in AI chip making. Its strong earnings, steady growth, and rising demand helped push its stock price to new highs.

Why is Bitcoin hitting new highs?

Bitcoin is rising because big investors are buying it through ETFs. Also, people trust it more now, and news about better crypto rules is helping too.

Disclaimer: