- Meyka AI's Newsletter

- Posts

- Dow, S&P 500, Nasdaq Futures Push Up: Stock Market Eyes Key Events

Dow, S&P 500, Nasdaq Futures Push Up: Stock Market Eyes Key Events

U.S. futures edge higher as investors look ahead to Fed signals, tech earnings, and key economic reports that could shape the market's next move.

Table of Contents

U.S. stock futures are pointing higher today. The Dow, S&P 500, and Nasdaq are all up in early trade. That’s a sign of hope after recent market swings.

We’re seeing renewed interest from investors. Why? Because this week is packed with big events. There’s a lot to watch, including major earnings reports and key economic data.

Wall Street is trying to guess what comes next. Will the economy stay strong? Will the Fed change its tone? Will tech stocks keep pushing higher?

Let’s find out what’s driving the market. We’ll explore what’s moving futures, what events matter most, and how we can prepare for what’s ahead.

Market Overview

Meyka AI: Stock Overview on Charts

Dow, S&P 500, and Nasdaq futures rose modestly this morning. Futures data show S&P up about 0.2%, Nasdaq up 0.4%, and the Dow slightly higher. Asian markets were mixed after U.S.-China trade talks ended without a deal. Still, recent bullish sentiment carried U.S. indexes to record highs. Investors seem hopeful, but still cautious.

Key Events Driving Sentiment

We are watching a trio of powerful market drivers this week. First, economic reports. Q2 U.S. GDP is expected to rise near 2.5%, after a slight first-quarter dip. The July jobs data (ADP and non‑farm) will give clues on hiring trends.

Second, the Federal Reserve decision. The Fed meeting wraps up today. We expect no change in rates, staying at 4.25-4.50%, but investors focus on Powell’s tone. He may hint at rate cuts in September. Internal dissent in the Fed is possible, as Governors Waller and Bowman may vote “no,” but it likely won’t affect policy. Their dissent would be seen as symbolic rather than a shift.

Third, corporate earnings. Meta and Microsoft report on Wednesday. Amazon and Apple follow on Thursday. Their results carry huge weight over tech indexes. Analysts will watch AI‑related guidance and spending plans. So far, about 80% of S&P firms beat earnings estimates, with modest but steady growth in profits.

In addition, trade developments still matter. The U.S.‑EU trade deal cut tariffs to 15%, which smoothed investor worries. Talks with China continue in Stockholm to extend the truce past August 12. If Trump does not extend, tariffs could snap back, raising market risks.

Sector Watch

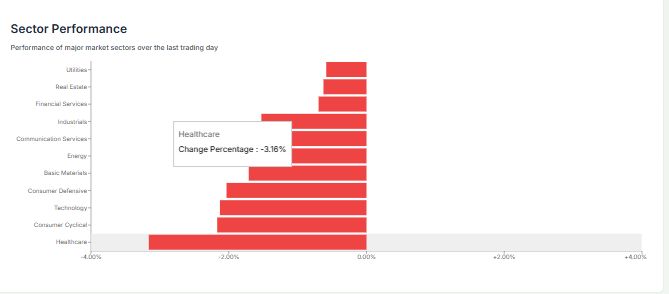

Meyka AI: US Market Sector Performance Highlights

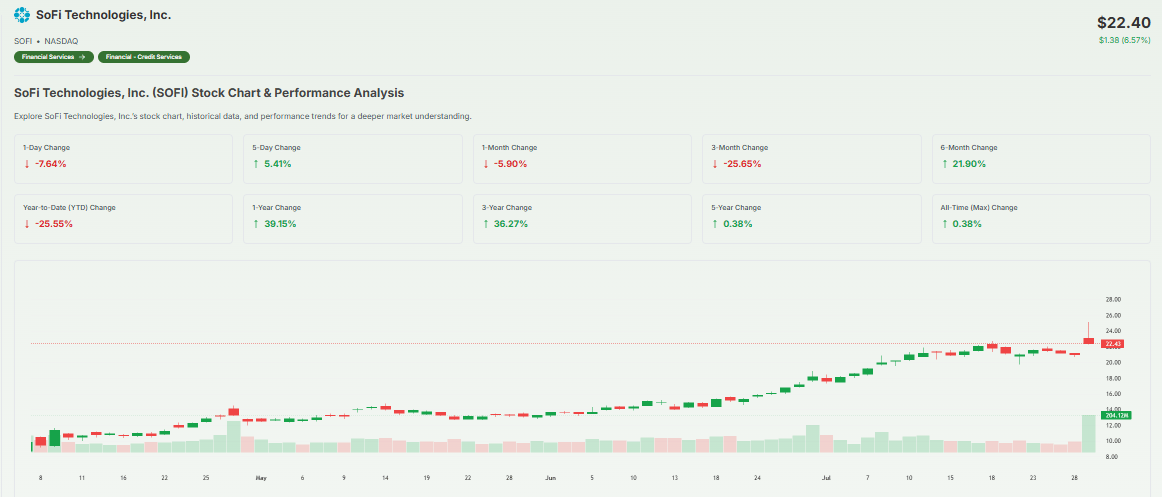

Tech-related futures lead the gains. AI and tech stocks are in focus, thanks to strong investor interest. Financial and industrial sectors are flat or slightly lower. Real rates matter, and bond yields are soft ahead of the Fed decision. Energy is steady. Notable pre‑market movers include shares in SoFi, which jumped on earnings news, while Merck, UnitedHealth, and UPS eked out declines after weak forecasts.

Meyka AI: SOFI Shares Chart Overview

Market Opinions Right Now

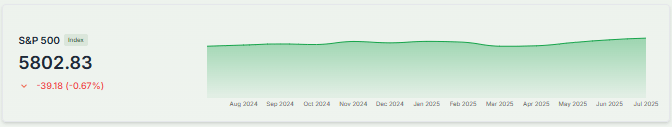

MEYKA AI: S&P 500

Retail investors are fueling much of the rally. Their share of S&P 500 flows recently surpassed 12.6% the highest since February. Many expect market gains ahead, with bullish sentiment climbing. Morgan Stanley’s data shows 62% of retail buyers expect further gains. Meanwhile, institutional hedge funds have taken some profits.

Analyst targets are rising. Oppenheimer, riding earnings optimism and eased trade fears, lifted its S&P 500 year-end target from about 5,950 to 7,100.

Technical Trends to Watch

Recent closes for the S&P 500 and the Nasdaq set new records. Now they sit near key resistance zones. If futures stay strong, fresh highs are possible. On the downside, important technical supports lie near recent breakout levels. Market breadth remains healthy. Indicators like RSI and MACD hint at momentum, but extended gains may spur profit‑taking soon. Volume trends suggest cautious optimism. Analysts suggest waiting for pullbacks before adding positions.

What to Watch Next (Wrap‑Up)

We’re tracking three big risks and opportunities. First, the Fed’s statement and press conference. A dovish tone could push yields lower and boost tech. Second, Q2 GDP and July jobs data. A strong print would support markets. Third, earnings from Big Tech. Investors will parse AI guidance carefully.

Trade risk remains. If tariff deadlines pass without extension, markets may react sharply. Finally, retail sentiment and valuations face scrutiny. We may see volatility if speculators pull back.

We see potential, but we’re watching closely. This week has big events, a calm Fed meeting or strong earnings may lift stocks; hawkish tone or earnings misses could trigger a reset. Either way, we watch carefully and weigh each signal.

Frequently Asked Questions (FAQs)

Why are stock futures up today?

Stock futures are rising because investors feel hopeful about tech earnings and the Fed’s upcoming decision. Strong economic data and fewer worries about global trade also help boost confidence.

What is the Fed expected to do this week?

The Fed is expected to keep interest rates the same. Investors will listen closely to the Fed’s statement to see if rate cuts might happen later this year.

How will Big Tech earnings affect the stock market?

Big Tech earnings can move the market because these companies are very large. If they report strong results, stocks may rise. Weak numbers could cause the market to fall.

Disclaimer: