- Meyka AI's Newsletter

- Posts

- Friday’s Jobs Report: Will It Shake the S&P 500, Nasdaq, and NYSE?

Friday’s Jobs Report: Will It Shake the S&P 500, Nasdaq, and NYSE?

One report. Three major indices. Traders are on edge with endless questions!

U.S. markets head into Friday, February 13, 2026, with rising tension as investors await the latest Jobs Report, one of the most powerful market-moving events of the month.

U.S. Stock Market: Top Market Signals This Week

Markets are entering Friday, February 13, 2026, in a highly sensitive state. Several warning signs are flashing across equities, bonds, and economic data. Traders are bracing for a sharp move once the U.S. Jobs Report is released.

Check Key Index Levels on Meyka AI Before the Market Opens

Key market signals shaping sentiment:

Bond yields falling: The 10-year Treasury yield slipped to 4.14%, the lowest level in nearly four weeks, which signals rising economic caution.

Weak retail sales: December retail sales came in flat at 0.0% vs. +0.5% expected, raising fears of slowing consumer demand.

Job openings plunge: The latest JOLTS report showed 6.54 million openings, well below forecasts of 7.2 million.

Private hiring miss: ADP data showed only 22,000 private jobs added, missing estimates of 42,000.

The data will reveal how many jobs were added in January and whether hiring is slowing. This matters because the labor market now shapes interest-rate expectations, stock prices, and investor confidence. Recent layoffs, weaker hiring plans, and falling bond yields suggest the economy may be cooling.

At the same time, tech stocks remain fragile after weeks of volatility. A single surprise in this report could push the S&P 500, Nasdaq, and NYSE sharply higher or lower, within minutes.

Why this matters for your trades:

When hiring slows and yields fall, markets often reprice interest-rate expectations quickly. This triggers volatility across stocks, bonds, and currencies.

What Will Friday’s Jobs Report Reveal?

The U.S. Labor Department’s Employment Situation Report for January 2026 will provide three major signals that shape market direction.

How many jobs were added?

Economists expect payrolls to rise by 65,000-70,000 jobs, up slightly from 50,000 in December, but far below historical averages.

Reuters survey forecast: +70,000 jobs

Bank of America estimate: +45,000 jobs

Full forecast range: 45,000 to 90,000

Such low hiring levels suggest corporate caution, slower expansion, and tighter labor supply.

Will unemployment rise further?

The unemployment rate is forecast to stay at 4.4%, near its highest level since 2021.

Why this matters:

Above 4.5%, recession fears usually accelerate.

Stable unemployment with weak hiring suggests labor stagnation, not strength.

Economists note that stricter immigration rules and slower population growth are shrinking the labor supply, masking deeper weakness.

What will wage growth signal?

Wage growth is forecast at 0.2%-0.3% month-over-month. Slower wage gains reduce inflation pressure and increase the odds of Federal Reserve rate cuts, which generally support stock prices.

AI-Powered Insight Explained: What are the Market Scenarios?

Using multi-factor modeling from an AI stock analysis tool, three dominant market scenarios emerge.

What happens if the jobs data is weak?

If payrolls fall below 50,000:

Rate-cut bets increase

Bond yields fall

Nasdaq and growth stocks rally

S&P 500 targets 7,000 resistance

Market psychology shifts toward stimulus-driven optimism.

What if data matches expectations?

If payroll lands between 60,000 and 90,000:

Limited market movement

Sector rotation continues

Financials and industrials lead

Lower volatility session

Markets interpret this as a controlled economic slowdown.

What if jobs data surprises to the upside?

If payrolls exceed 120,000:

Bond yields spike

Rate-cut hopes fade

Nasdaq underperforms

S&P 500 risks a 2-3% pullback

This outcome pressures high-valuation tech stocks.

Risk & Breakout Levels to Monitor

Technical levels provide traders with clear risk management zones around the jobs data.

S&P 500 (SPX)

Support: 6,880 – 6,900

Resistance: 6,980 – 7,000

A breakout above 7,000 could confirm bullish momentum.

Nasdaq 100 (NDX)

Support: 22,800

Resistance: 23,600

Weak labor data could trigger a momentum breakout.

Dow Jones (DJIA)

Support: 49,500

Resistance: 50,300

Rotation favors industrials and financials during economic stabilization phases.

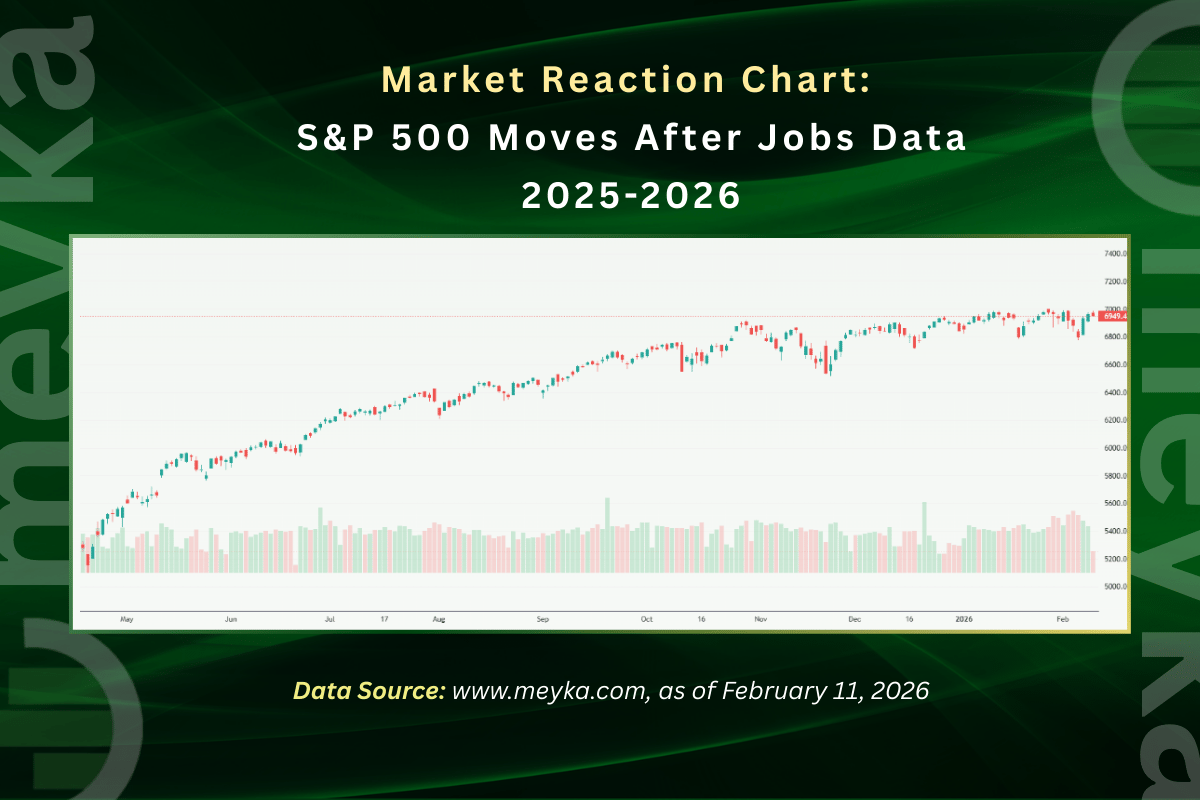

Chart of the Week: How Markets React to Jobs Data

Over the past 12 months, the S&P 500 moved an average of 1.6% intraday on jobs-report days. The largest swing occurred in October 2025, when a payroll miss triggered a 3.4% rally within one session.

This pattern shows:

Weak data = stocks up

Strong data = stocks down

The driver remains interest-rate expectations, not labor conditions alone.

Quick Screener Alerts: Stocks in Focus

Based on volatility trends and sector rotation, these stocks show elevated trading interest.

Bullish setups

NVIDIA (NVDA): AI dip buying support

Microsoft (MSFT): Cloud demand resilience

Amazon (AMZN): Support bounce forming

Defensive plays

Johnson & Johnson (JNJ)

Utilities Select Sector ETF (XLU)

High-volatility trades

Invesco QQQ Trust (QQQ)

These names often react sharply to macro data surprises.

Actionable Next Steps for Traders

Preparing for volatility improves trade execution and reduces emotional decisions.

Tighten stop losses before the 8:30 AM ET release

Watch the 10-year Treasury yield reaction first

Track Fed funds futures for rate-cut probability

Prepare two trade plans: breakout or reversal

Reduce leverage before data release

Disciplined preparation turns uncertainty into opportunity.

Run Your Own Market Scenario: Explore how different payroll outcomes could impact major indices in real time.

Conclusion: What This Jobs Report Means for Your Portfolio?

Friday’s jobs report stands as one of February’s most powerful market catalysts. This report could define short-term market direction. Traders who prepare for both outcomes stay ahead of swings in the S&P, Nasdaq, and Dow.

Frequently Asked Questions (FAQs)

How will the U.S. jobs report affect the stock market today?

On February 13, 2026, the U.S. jobs report may move stocks quickly. Weak hiring could lift markets on rate-cut hopes, while strong data may pressure tech and growth shares.

Will Friday’s jobs data move the S&P 500 and Nasdaq?

Yes. On February 13, 2026, jobs data could cause sharp moves in the S&P 500 and Nasdaq. Traders watch payroll and wage trends to adjust risk and short-term market positions.

Is the U.S. labor market slowing in 2026?

Recent data in early 2026 shows slower hiring, fewer job openings, and rising layoffs. These signs suggest the U.S. labor market is cooling, though it remains stable overall.

Disclaimer: