- Meyka AI's Newsletter

- Posts

- From Blockade to Barrels: How Sanctions Relief Could Lift Venezuela’s Oil Output to 1.2 Million bpd

From Blockade to Barrels: How Sanctions Relief Could Lift Venezuela’s Oil Output to 1.2 Million bpd

Venezuela’s oil comeback may shift the global energy map

In December 2025, the United States moved to block Venezuelan oil exports at sea. This action cut shipments and helped push Venezuela’s crude output down sharply.

By January 2026, political events made the world take notice. The U.S. captured Venezuela’s president, and Washington signaled a possible shift in sanctions policy.

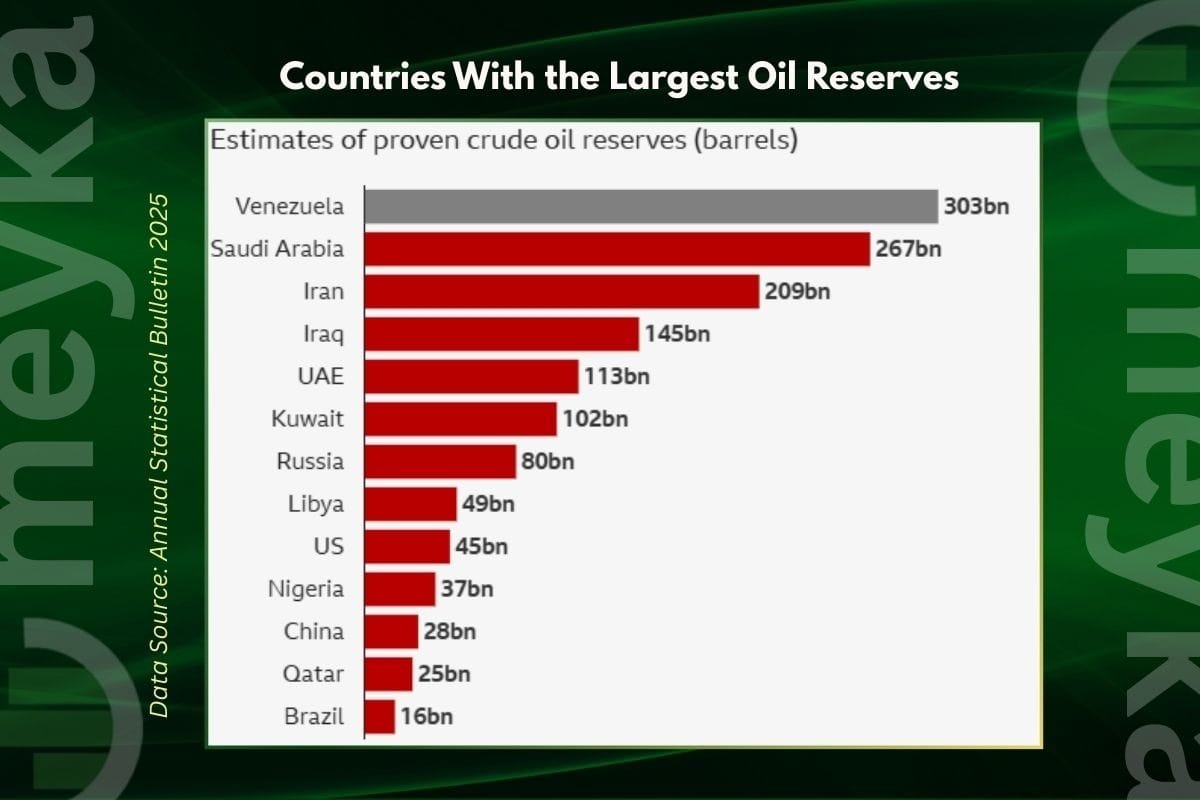

Venezuela still sits on some of the largest oil reserves on the planet. But its production has fallen to well under one million barrels per day.

Now, analysts and traders are talking about a big change. If sanctions are eased and foreign investment returns, Venezuela could boost its oil output toward 1.2 million barrels per day by the end of 2026.

This shift would do more than lift barrels. It could change who buys Venezuelan crude, reshape refinery plans, and affect global oil prices. The question is no longer if output could rise, but how fast and under what terms.

The Blockade and Sanctions Environment: What Changed?

After years of tight sanctions, Venezuela’s oil exports have been under severe pressure. U.S. policy toward Venezuelan oil has shifted several times since strict sanctions began in 2019. These sanctions blocked most oil sales and foreign investment. They also cut the state oil company, PDVSA, off from major financing. As a result, Venezuela’s oil output fell from historic highs to well below full capacity.

In late 2025, the United States took further action with a naval blockade designed to enforce sanctions more strictly. Analysts say this move pushed output down even more.

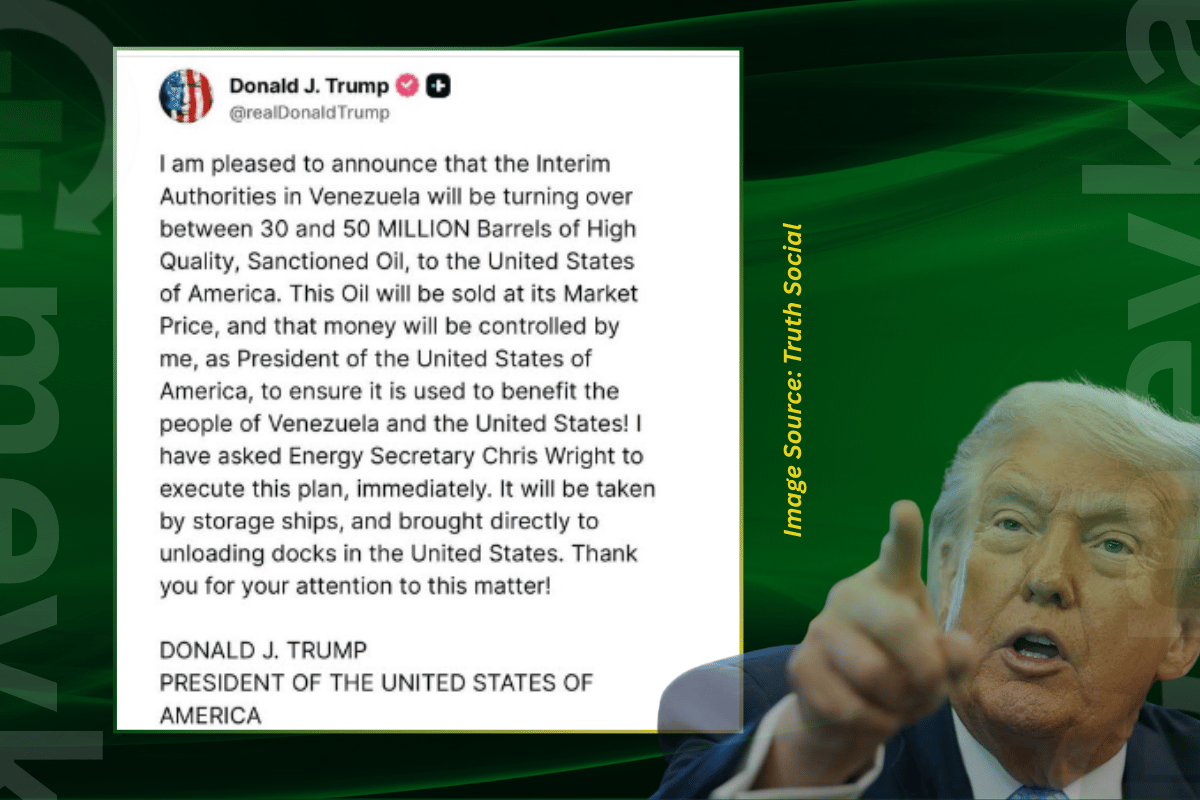

In early January 2026, U.S. political and military events raised new questions about sanctions. The U.S. government removed President Nicolás Maduro from power, and President Donald Trump announced plans to boost Venezuela’s energy sector by easing restrictions and allowing greater oil exports.

These developments could pave the way for Venezuela to re-enter global oil markets more fully. But the outcome depends on how sanctions are revised and how quickly companies can return to invest.

How Sanctions Relief Could Unlock 1.2 Million bpd?

If sanctions are eased, analysts see potential for Venezuela’s oil output to rise significantly by the end of 2026. Current production sits at roughly 800,000-900,000 bpd, far below its true capacity.

Industry models show that lifting trade barriers and export limits could add around 400,000 barrels per day over the next 12 months.

Much of the potential increase would go to Gulf Coast refiners in the U.S. These facilities were built to handle Venezuela’s heavy, sour crude grades. If they can import sanctioned crude again, overall shipments could rise sharply.

A key factor is returning Venezuelan crude to markets at normal trade terms. Historical data shows that U.S. Gulf Coast refiners once took about 650,000 bpd of Venezuelan crude before global sanctions tightened.

That means sanctions relief would not just free barrels, it would revive trading relationships that have lain dormant. But the full jump to about 1.2 million bpd by the end of 2026 depends on political stability, investment flows, and the pace of industry repairs.

Structural Roadblocks: Why Output Won’t Snap Back Overnight?

Even with sanctions lifted, Venezuela faces real hurdles that slow any rebound.

First, its oil infrastructure is badly worn. Pipelines, wells, and field equipment need urgent repair. Years of under-investment and neglect have taken a toll. Analysts warn this decay will slow production gains.

Second, Venezuela lacks the drilling rigs and investment capital needed to expand quickly. Experts estimate that dozens of rigs and billions of dollars in upgrades would be required just to bring output back toward historic levels.

Third, PDVSA’s workforce has shrunk, and many trained engineers have left the industry over the years. Reclaiming technical expertise will take time and money.

Lastly, the country’s heavy oil requires blending with lighter crude or diluents to flow through pipelines. These supplies are not readily available without international partners and investment. Even with sanctions lifted, that factor slows growth.

Refinery Readiness & Market Oil Demand Dynamics

Venezuela’s potential oil revival would not just be about lifting sanctions. Buyers must be ready to take its barrels.

In the U.S., several Gulf Coast refineries are well-positioned because they are designed to process heavy, high-sulfur crude like Venezuela’s. For example, Phillips 66 has announced that two major Texas refineries can handle Venezuelan crude once exports resume fully.

That matters because U.S. demand for heavy crude has been under pressure since sanctions cut off Venezuelan barrels. Many refiners shifted to other sources, but those alternatives often cost more and are less suited to local configurations.

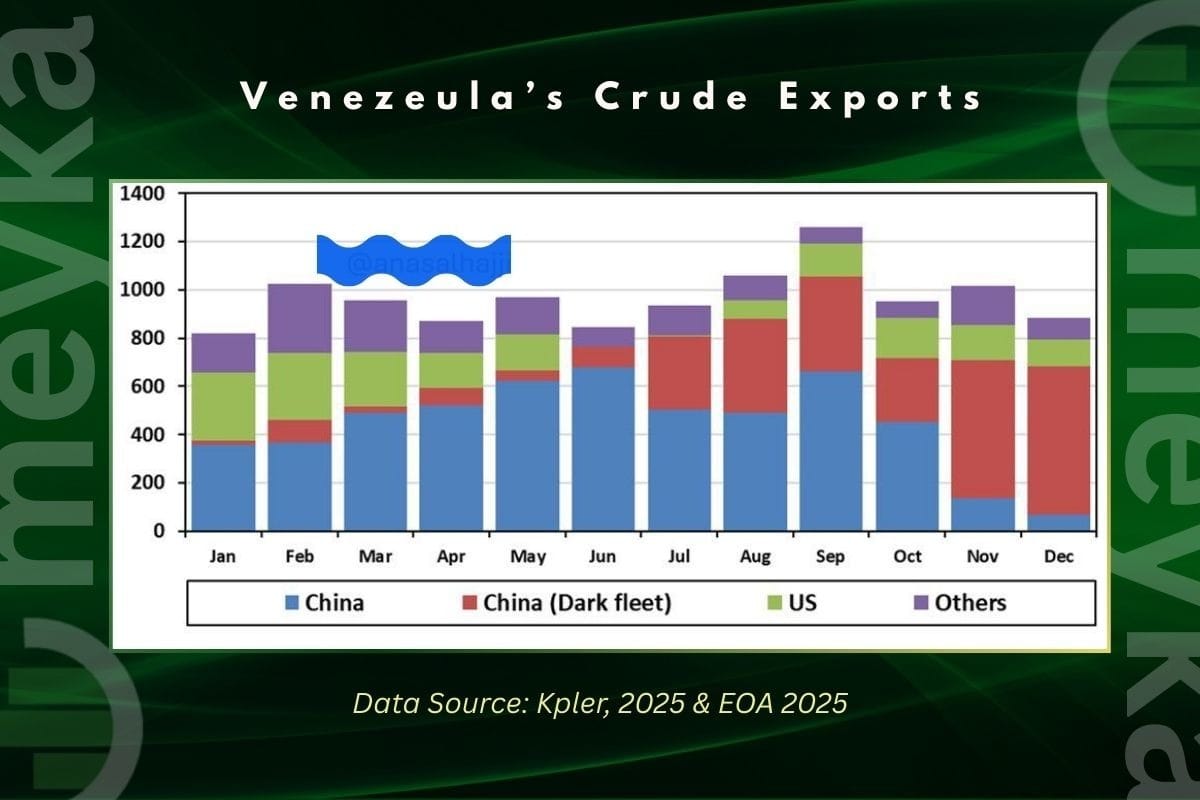

Across the globe, Asia also has an appetite for barrels if they can be delivered reliably. In recent years, China bought large volumes of Venezuelan crude, often via indirect channels. If Venezuela returns to more open trade terms, markets in India, Europe, and the Caribbean could also resume purchases.

These shifts would reshape global crude flows and give refiners more choices. But demand patterns will only change if supply is reliable and legal protections for buyers are clear.

Global Oil Markets: Supply, Prices, and Strategic Impact

The return of Venezuelan barrels to global markets would hit at a time of plenty. Many analysts expect oil supply to exceed demand in 2026, keeping prices under pressure.

Adding up to 400,000 barrels per day or more from Venezuela would add to this surplus. That could push oil prices lower if demand does not keep pace. At the same time, major producers like OPEC+ continue to manage output to support prices.

Goldman Sachs and other banks see a scenario where Venezuelan production growth could even influence prices over the long run, projecting that large output gains might shave a few dollars off global crude benchmarks by 2030.

But prices depend heavily on demand signals, geopolitics, and macroeconomic trends. Even strong Venezuelan gains might not dramatically lower prices if global demand falters or other producers cut output.

Policy Underpinnings: What Must Happen Next?

For Venezuelan oil output to really climb toward 1.2 million bpd by the end of 2026, policy shifts must follow.

First, U.S. sanctions must be reconfigured to allow broader foreign company participation. Washington has signaled it may ease restrictions and grant wider authorization for oil exports and partnerships beyond just Chevron.

Second, Venezuela’s government needs to offer stable legal frameworks that protect investors. That often means clear rules on profit repatriation and asset ownership.

Third, rebuilding trust with traditional buyers in Europe, Asia, and the U.S. is essential. It will take more than policy changes; it requires predictable execution.

Even if sanctions are eased, there is no guarantee that capital will flow quickly. Many companies are cautious after years of risk and loss. The time needed for negotiations, compliance, and new agreements will define how quickly Venezuela’s oil can return to the world stage.

Conclusion & Forward Look

Sanctions relief could unlock much of Venezuela’s lost oil potential. A rise toward roughly 1.2 million bpd by the end of 2026 is possible. But it is not automatic. It depends on political shifts, massive investment, and confidence from global markets.

The near term is promising on paper. Policy conversations in early January 2026 point to openings that could bring Venezuelan crude back into major markets. But real change takes time, money, and stable rules. Only then can the “from blockade to barrels” moment become a lasting reality.

Frequently Asked Questions (FAQs)

Can Venezuela reach 1.2 million bpd oil output?

Analysts say Venezuela could reach 1.2 million bpd by late 2026 if U.S. sanctions ease, exports reopen, and repairs continue, though funding and infrastructure risks remain.

Why do U.S. sanctions matter for Venezuelan oil?

U.S. sanctions limit buyers, payments, and equipment access. Relief in 2026 would allow legal oil sales, attract partners, and improve cash flow for production.

Will Venezuela’s oil increase affect global prices?

Higher Venezuelan supply in 2026 could add barrels to markets and pressure prices if demand stays weak and other producers keep output unchanged.

Disclaimer