- Meyka AI's Newsletter

- Posts

- Global Markets on Edge: Dow, S&P 500, Nasdaq & FTSE 100 React to Trump’s Greenland Tariff Shock

Global Markets on Edge: Dow, S&P 500, Nasdaq & FTSE 100 React to Trump’s Greenland Tariff Shock

Tariff news rattles U.S. and European markets

On January 20, 2026, global markets moved sharply. Investors were caught off guard by new tariff threats tied to the Greenland dispute. U.S. President Donald Trump said he would impose import taxes on several European countries unless they agree to talks about Greenland. This plan tilted markets toward fear. Stocks fell hard, with the Dow Jones, S&P 500 and Nasdaq all sliding on heavy selling. European indexes like the FTSE 100 also weakened. The shock did not stop at shares. Bonds, currencies and commodities felt the stress too as traders sought safer assets.

Many people see this event as more than a trade issue. It is now tied to rising geopolitical tensions. The sudden move shows how politics and market forces can collide fast. Let’s break down the market reaction, what caused it, and why it matters for investors.

Anatomy of the Selloff: Dow, S&P & Nasdaq

U.S. Stock Market Breakdown

On January 20, 2026, U.S. stock markets suffered a heavy drop after news of new tariff threats tied to Greenland spread through trading floors. The Dow Jones Industrial Average fell about 870 points (1.8%), the S&P 500 sank roughly 2.1%, and the Nasdaq Composite slid around 2.4% all marking their worst day since mid‑October. The declines wiped out early gains for 2026 and dragged both the S&P and Nasdaq below their 50‑day moving averages, a key technical level that many traders watch closely.

Tech stocks led the drop. High‑valuation names such as Nvidia and Tesla were especially weak, as investors rotated away from riskier assets. Many traders also noted a “Sell America” trend: money flowed out of U.S. stocks, bonds, and the dollar at the same time, showing broad risk aversion rather than isolated stock weakness.

Volatility & Fear in Action

Volatility spiked sharply, measured by the VIX fear gauge climbing above 20, the highest level in weeks, signaling increased uncertainty. This session highlighted how quickly markets can shift when geopolitical tensions hit economic terrain.

The FTSE 100 & Europe’s Reaction

European markets also felt strong pressure in late trading as risk aversion rippled across the globe. Major European indexes opened sharply lower on Monday, January 19, 2026, as threats of fresh tariff escalation between the U.S. and its European allies grew. France’s CAC 40 dropped as much as 1.8%, Germany’s DAX fell about 1.4%, and the FTSE 100 slipped roughly 0.4%. The broader STOXX 600 index moved down around 1.3% as nervous investors pulled back from risk assets.

Meyka AI: FTSE 100 (^FTSE) Index Overview, January 21, 2026

Investors interpreted the tariff talk as a signal of rising political tension between the U.S. and Europe over Greenland. European leaders have been critical of U.S. pressure, and the clash fed uncertainty around trade relations just as earnings season and economic data releases approach.

Currency markets reacted too. The euro strengthened against the U.S. dollar, reflecting weak dollar demand amid global risk shifts. Safe‑haven flows and shifting trade expectations helped shape this early European response.

Bonds, Dollar & Safe Havens

In a typical risk‑off event, investors move money into safe assets like the U.S. Treasuries and the dollar. But this selloff was unusual. Instead of rising, U.S. Treasuries sold off and yields climbed, while the U.S. dollar weakened. This signals widespread concern about U.S. economic strength and global policy.

Meyka AI: US Dollar Index (DX-Y.NYB) Index Overview, January 21, 2026

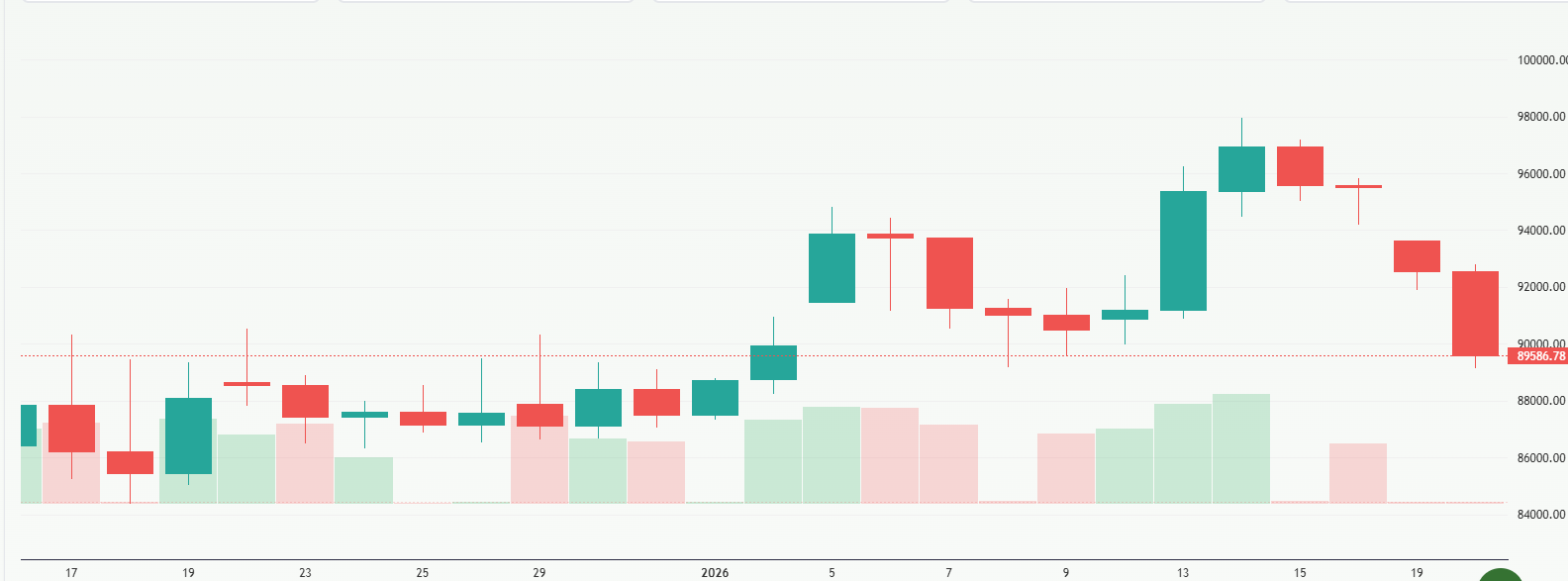

Gold, by contrast, soared to record or near‑record highs as traders sought stable stores of value amid the turmoil. Silver and other precious metals also saw strong gains, overshadowing many traditional safe‑haven plays. Cryptocurrency markets, including Bitcoin, declined, countering the expectation that crypto assets might benefit in times of stock market stress.

Meyka AI: Bitcoin USD (BTCUSD) Stock Overview, January 21, 2026

The broad move into metals and away from even government bonds highlighted a deep unease that this tariff shock could enlarge into something far more than a simple trade dispute.

Geopolitics Meets Economics: Greenland as a Market Catalyst

Why Greenland?

The market shock began over something unusual: Greenland. President Donald Trump tied potential tariffs to negotiations over U.S. interest in acquiring or exerting influence over the territory. This connection of trade policy to a geopolitical ambition amplified investor fear.

On January 17, 2026, President Trump announced that a 10% tariff would begin on February 1, rising to 25% by mid‑year, targeting European nations opposed to the Greenland plan. These tariffs would remain until an agreement over Greenland was reached.

European Pushback & Trade Risk

European allies reacted sharply. Leaders in Denmark, France, Germany and other nations rejected the notion of transferring Greenland. Instead, they warned that such threats could destabilize long‑standing economic and diplomatic ties. The political clash fed market fear as investors worried that negotiations could escalate rather than de‑escalate.

Risk Of Escalation

This episode showed how markets are not only about earnings and data. They are deeply sensitive to political narratives that can change trade flows, supply chains and investor expectations almost instantly.

Cross‑Asset Indicators & Investor Signals

The selloff extended beyond stocks. As risk aversion grew, indicators across asset classes showed synchronized weakness. Volatility indexes spiked, suggesting traders were uncertain about near‑term direction. Stocks, bonds and the dollar all lost ground at once, a rare but telling sign of broad investor anxiety.

Gold’s surge demonstrated traditional risk‑off behavior. When markets fear economic or political instability, gold often draws capital as a perceived safe asset. Meanwhile, the dollar’s retreat versus major currencies showed less confidence in the U.S. economy compared with global alternatives.

Equity sector patterns also shifted. High‑valuation technology stocks, particularly those tied to AI and growth expectations, bore a disproportionate share of losses. Investors instead moved capital to more defensive or value‑oriented sectors, reflecting a broad reassessment of risk and reward at this market moment.

What Comes Next? Market Catalysts To Watch

Looking ahead, markets will watch several key drivers. First is economic data, including upcoming inflation, jobs, and growth figures. If data shows slowing growth, risk assets could stay fragile. Second, policy responses matter. Central banks and government leaders may step in with statements or action to calm markets or reaffirm trade policy direction.

Investors should also track earnings announcements, which could counter or deepen selloff narratives. Strong corporate results may lift confidence, while weaker reports could worsen sentiment. Technical levels like the 50‑day averages in key indexes may act as battlegrounds for buyers and sellers. Finally, geopolitical signals, particularly any new moves on Greenland, tariffs, or allied response,s will stay central to shaping sentiment and capital flows.

Conclusion: Narrative Beyond Numbers

The January 2026 market reaction was more than a simple selloff. It was a moment when politics and markets collided sharply. Trade policy tied to geopolitical goals caused rapid repositioning across stocks, bonds, currencies, and commodities. Investors reacted not just to tariffs, but to the uncertainty about future policy and global alliances.

This period showed once again that markets are highly sensitive to political risk. Staying informed and disciplined remains key to handling such volatile periods.

Frequently Asked Questions (FAQs)

How did Trump’s Greenland tariff hit US stocks?

On January 20, 2026, U.S. markets fell sharply after Trump threatened new tariffs tied to Greenland. The Dow, S&P 500, and Nasdaq all dropped over 1.7%, driven by fear of trade tensions.

Which European markets fell after the tariff news?

European stock indexes, including France’s CAC 40, Germany’s DAX and the FTSE 100, slid on the tariff threat. Shares dropped as traders reacted to rising trade uncertainty with the U.S.

What should investors watch next after the sell‑off?

Investors will watch upcoming economic data, earnings reports and any policy moves from global leaders. These could shape markets after the tariff‑linked selloff.

Disclaimer: