- Meyka AI's Newsletter

- Posts

- Gold’s New ATH Explosion: Did My $3735 Call Hit the Jackpot?

Gold’s New ATH Explosion: Did My $3735 Call Hit the Jackpot?

A surprise September 2025 Fed rate cut creates new trade dynamics

Table of Contents

Table of Contents

Do you know the U.S. now has a new Stargate Project tied to artificial intelligence? In January 2025, OpenAI, SoftBank, Oracle, and MGX teamed up to launch “Stargate LLC,” an AI venture looking for $500 billion in infrastructure by 2029. This bold project has already stirred buzz in tech and policy circles.

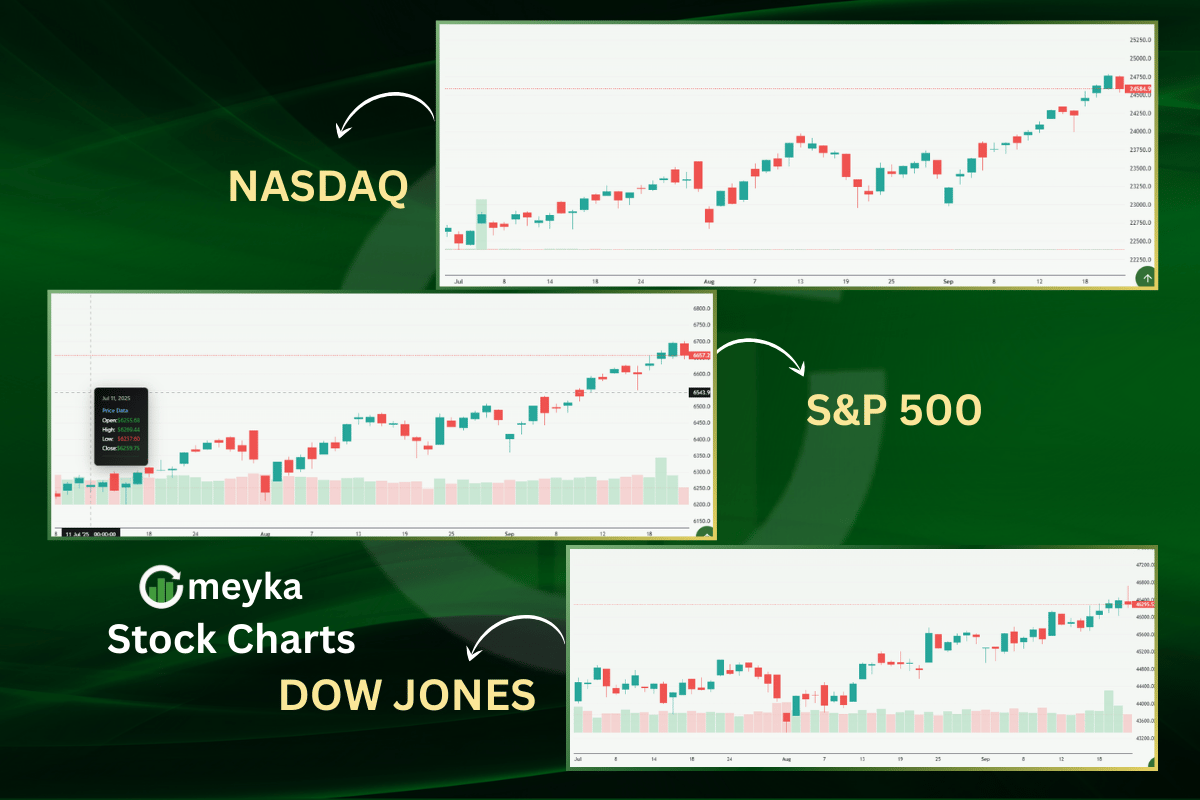

Meanwhile, on September 17, 2025, the Federal Reserve cut its federal funds rate by 25 basis points. This lowers the range to 4.00 %-4.25 %. That was the first rate cut in months. Markets surged. Tech stocks led. We saw new highs in U.S. equities.

Let’s explore how the new Stargate Project and the Fed’s move tie together. We track the market records, tech gains, and the shifts in trade dynamics. We ask: do these powerful forces connect? And what does it all mean for investors, tech watchers, and curious minds?

The Stargate Project: A Look Back and Its New Form

The Stargate Project grew from a big public push in January 2025. OpenAI and partners announced a plan to build massive AI data centers. The initiative aims to add gigawatts of compute and hundreds of billions in investment. The stated goal is to secure U.S. leadership in AI and to rapidly deploy large-scale infrastructure. These plans placed tech policy and energy use at the center of public debate.

Fed Rate Cut: What Happened?

The Federal Reserve cut its policy rate on September 17, 2025. Officials lowered the target range by 25 basis points. The move followed signs of slower inflation and a cooling labor market. The Fed said the cut is intended to support a durable expansion while keeping inflation on track. Markets read the signal as a path to cheaper borrowing later this year. The Fed’s implementation note also adjusted the rate paid on reserve balances, effective September 18, 2025.

Stock Market Records After the Cut

Markets reacted quickly. U.S. equity indexes pushed to fresh record highs in the days after the Fed action. The S&P 500, the Dow Jones Industrial Average, and the Nasdaq all logged new closing peaks. Investors cited easier monetary policy and renewed interest in growth stocks. The rally was not only broad. It showed a strong tilt toward technology and AI-linked firms.

Tech Gains and AI Push

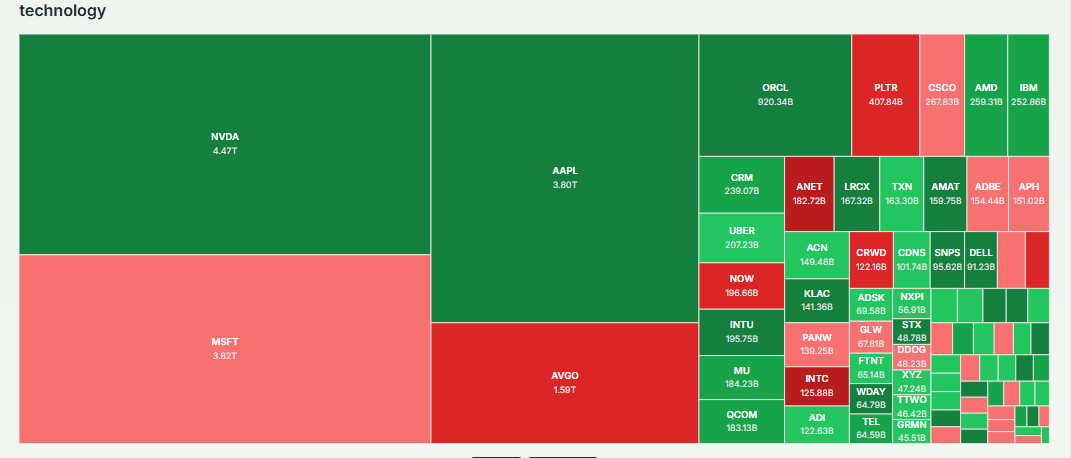

Meyka AI: Technology Stock Overview

Tech stocks led the gains. Chipmakers, cloud firms, and AI platform companies jumped as traders priced in faster demand for compute. Nvidia, Intel, and several cloud providers saw large moves. Nvidia’s ties to the Stargate buildout and its chip supply role drove extra attention. Big software names also rose on hopes that cheaper credit will help large AI projects move from planning to scale. Analysts noted that lower rates make multi-year capex cheaper. This boosts valuations for fast-growing tech firms.

Infrastructure and Energy Impact

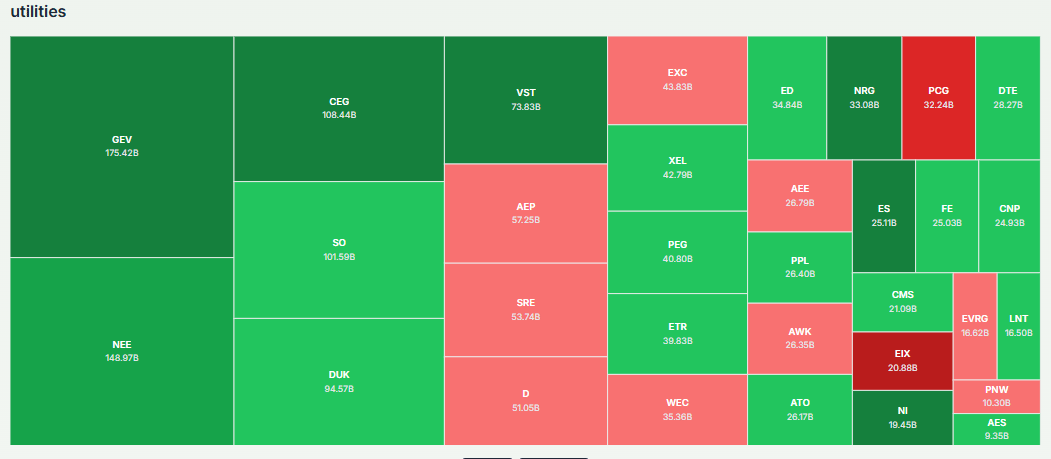

Growth in AI infrastructure creates follow-on demand. Data centers need power, networking, storage, and more chips. This demand lifts equipment makers and cloud operators. It also raises questions about energy supply and local grid capacity. Counties hosting new data centers might see job growth. They might also face strains on water, roads, and utilities. Policymakers must weigh the economic benefits against the local costs. Coverage of new Stargate sites highlights both the jobs and the infrastructure challenges.

Meyka AI: Utility Stock Overview

Global Trade and Currency Effects

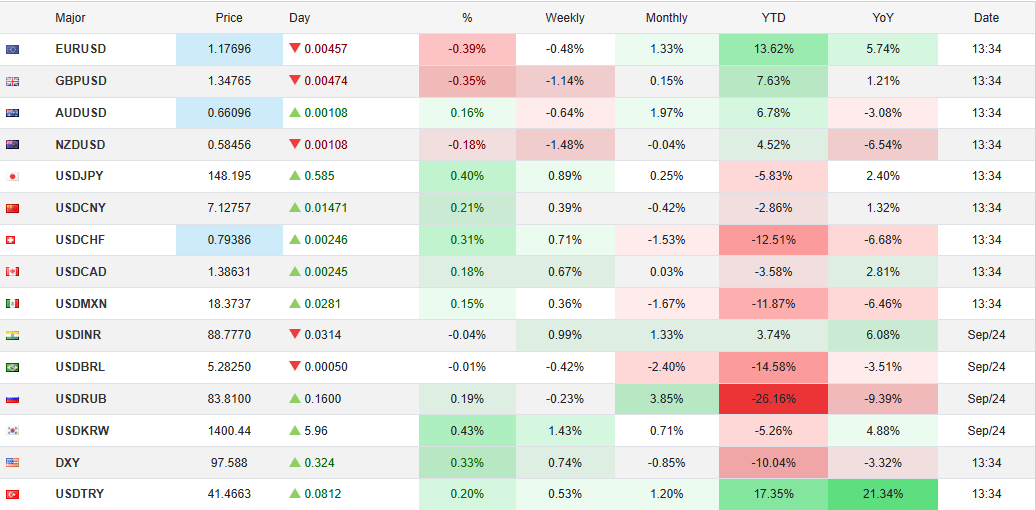

The Fed’s rate cut reshapes trade and currency flows. A lower U.S. policy rate tends to weaken the dollar. A softer dollar can help U.S. exporters by making goods cheaper abroad. It can also raise the local currency value of dollar-denominated commodities. Emerging markets feel this in two ways. Their exports to the U.S. can rise. But capital flows can shift as investors chase higher returns in U.S. assets or in riskier markets. Central banks in Asia and Latin America watch these moves closely. They may need to adjust rates or intervene in currency markets.

TradingEconomics Source: The U.S. dollar ticked higher after the Fed’s rate cut, showing short-term strength against major currencies.

Geopolitical Competition in Tech

Geopolitics now links to tech infrastructure. The Stargate Project was framed in part as a strategic move to keep AI capacity in America. That framing touches directly on U.S.-China tech competition. Investment partners and supply chains matter. When major firms commit billions to U.S. sites, global chip routing and cloud contracts rearrange.

Trade tensions could shape which countries host advanced nodes and which firms win long-term partnerships. Governments may add incentives or restrictions to protect national interests. Coverage of Stargate has emphasized its geopolitical edge and the possible ripple effects on trade.

Risks, Rewards, and Tools for Investors

Risk and reward are both clear in the current mix. On the reward side, cheaper rates and big infrastructure projects accelerate growth. Investors can see faster revenue paths for AI firms. Local economies can gain jobs and tax revenue. On the risk side, high valuations may create fragile market conditions.

Large, concentrated bets on a few tech names increase systemic risk. There are also operational risks in scaling massive data centers, from supply chain delays to energy shortages. Analysts recommend careful due diligence. Some investors now use an AI stock research analysis tool to test scenarios and stress-test assumptions.

Final Takeaway

The combination of the Stargate buildout and the Fed’s rate action is shaping a new chapter for markets and trade. Large-scale AI investments push demand for chips and data center services. Monetary easing lowers short-term financing costs.

Together, they create fertile ground for tech advances and market rallies. But they also. raise hard questions about who benefits, who bears the costs, and how resilient the system will be. Close attention to policy shifts, supply-chain signals, and energy constraints will be essential in the months ahead.

Frequently Asked Questions (FAQs)

How does a Fed rate cut impact the stock market?

A Fed rate cut, like on September 17, 2025, lowers borrowing costs. This often boosts investor confidence, raises stock prices, and makes growth companies more attractive.

Which stocks will benefit from US rate cuts?

Tech stocks, real estate, and consumer companies often benefit most from U.S. rate cuts. Lower borrowing costs help growth firms invest, expand, and increase their market value.

What is Stargate on the stock market?

Stargate, launched in January 2025 by OpenAI and partners, is a large AI infrastructure project. It is not a stock but influences demand for AI-related companies.

Disclaimer: