- Meyka AI's Newsletter

- Posts

- Gold to the Moon, Stocks Catch Their Breath, Positioning for a Potential Fed Cut

Gold to the Moon, Stocks Catch Their Breath, Positioning for a Potential Fed Cut

Gold shines brighter as markets wait in quiet anticipation

Table of Contents

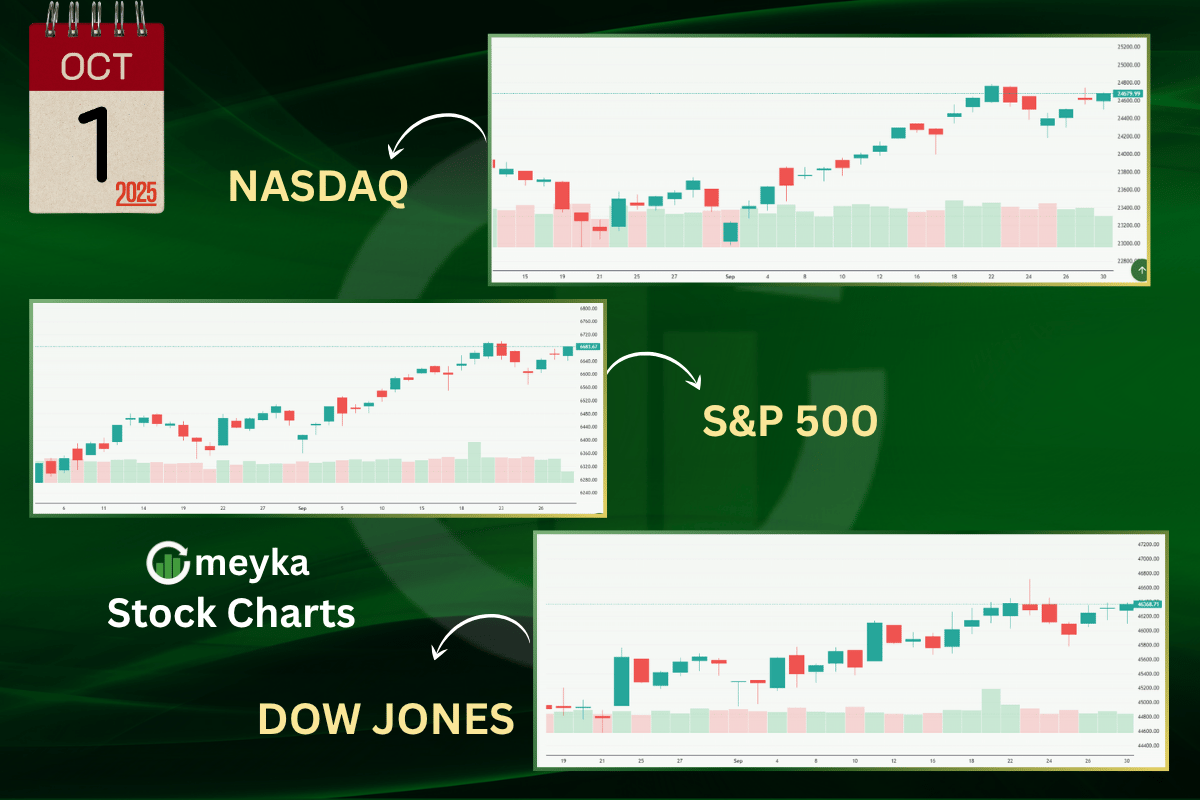

As of October 1, 2025, gold is racing higher up nearly 12% this year while major US stocks pause, digesting recent gains. We find ourselves in a curious spot: the metal is flashing safety signals, and equities seem to be catching their breath. Meanwhile, whispers of a possible Federal Reserve interest‐rate cut gather strength.

We will walk through three big questions: Why is gold climbing so fast? Why are stock markets resting now? And will the Fed really cut rates soon?

Let’s share insights and ideas for investors, and want you to understand what could come next and how to position wisely amid shifting tides.

Gold’s Meteoric Rise

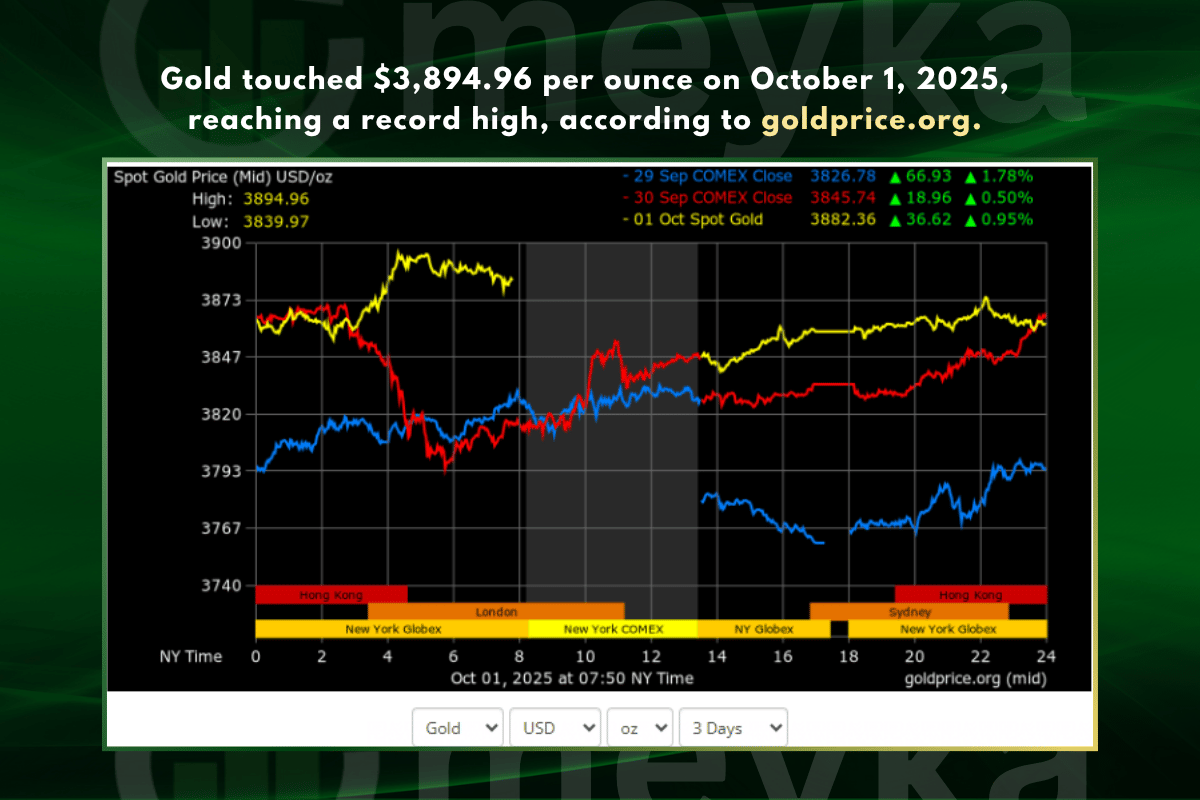

Gold has climbed to fresh highs. On October 1, 2025, spot gold briefly hit record levels near $3,895 per ounce as safe-haven demand spiked. Several drivers explain the move. A U.S. government shutdown raised risk concerns and weakened the dollar. Markets also priced in a near-certain Fed rate cut, which lowers real yields and lifts gold’s appeal.

Institutional buyers and central banks have added to demand this year, keeping physical flows strong. Historical rallies show that gold often surges when growth worries meet low real rates. Forecasts from major banks see gold trending higher through late 2025 and into 2026. This is making the recent highs part of a wider bullish cycle.

Stock Market Takes a Breather

Stocks paused after a strong September. The S&P 500 posted gains in the month but showed signs of consolidation as traders weighed fresh risks. Futures slipped when the government shutdown news hit, and market breadth thinned. Tech names led recent rallies, but profit-taking surfaced in richly valued growth stocks.

Defensive sectors gained on the safe-haven trade. Global markets were mixed: some European indexes rose while parts of Asia fell or traded cautiously amid holiday closures and export data. Investors are now focused on delayed economic announcements and upcoming corporate earnings.

The Fed Cut Question: Will It Happen?

Markets expect rate cuts this autumn. Fed funds futures show a high probability of a 25 basis-point cut at the October meeting and further easing later in the year. Traders place large odds on at least one cut in October and a second one by December if data softens.

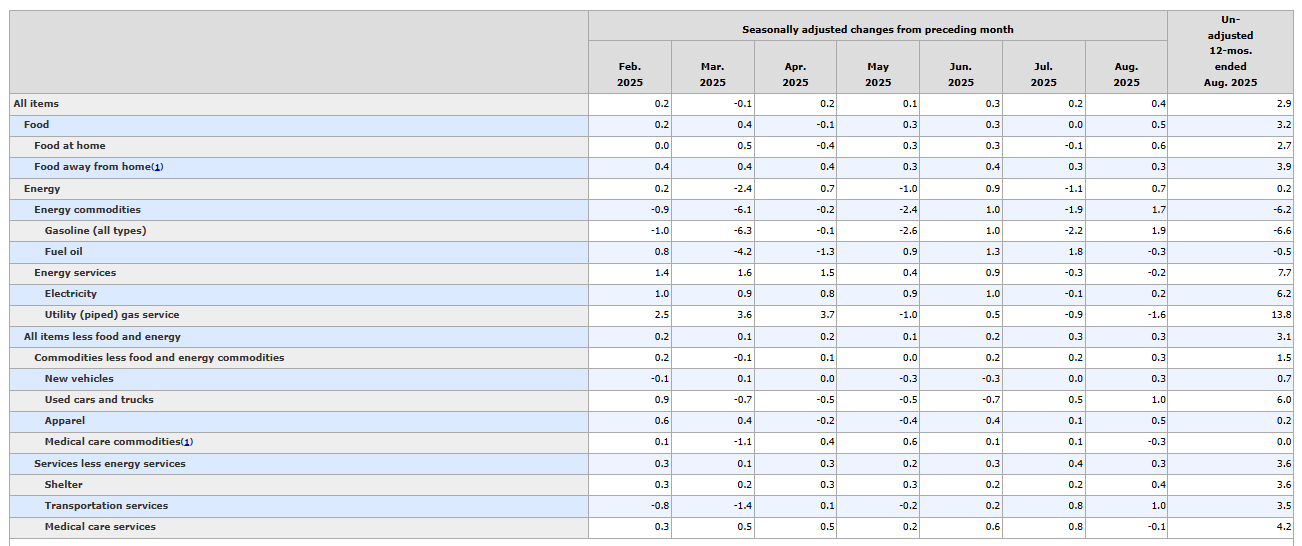

The inflation picture is mixed. Headline CPI rose to 2.9% year-over-year in August 2025, and core inflation held firmer around 3.1%. Those readings are lower than the multi-year peaks but still above the Fed’s 2% goal. Employment data has cooled, with monthly job additions running softer than earlier in 2024-2025.

Bureau of Labor Statistics Data Source: Inflation rose 0.4% in August 2025 and 2.9% over the year

The Fed faces a trade-off: cut too soon and risk inflation re-accelerating; wait too long and economic growth could stall. Analysts remain divided. Some argue that slowing jobs and softer retail and industrial data force a cut. Others warn that sticky wage growth and service-cost pressures limit how fast the Fed can loosen policy.

Positioning Strategies for Investors

Positioning matters with the macro picture shifting. For safety, some investors increase exposure to gold and selected Treasury durations. Lower real yields after a cut would likely support both gold and long-duration government bonds. Tactical investors may use ETFs for quick exposure or to hedge downside. For growth, selective tech and AI winners may still offer upside. However, valuation discipline is crucial.

Consider using an AI stock research analysis tool to screen for firms with resilient cash flow and strong balance sheets before increasing risk exposure. Diversification across asset classes reduces single-market risk. Commodities and selected emerging-market equities can help if the dollar weakens further. Risk management remains key. Use stop-losses, position limits, and cash buffers to survive sudden volatility.

Global Implications

A Fed easing cycle would ripple worldwide. A softer dollar would help commodity exporters and lift local-currency returns in many emerging markets. Conversely, central banks in countries with higher inflation may keep rates tight, creating policy divergence and capital flow swings. Commodity prices, already buoyed by safe-haven buying and demand recovery, could get another lift if global liquidity expands. Currency moves will affect companies with heavy dollar debt, so credit risk in vulnerable markets deserves attention.

Final Words

The current setup blends caution with opportunity. Gold’s record highs show strong demand for protection. Stocks are pausing after a stretch of gains, not collapsing. The Fed’s next moves will shape the next market phase. Investors should match their time horizon and risk tolerance to the likely scenarios. Short-term traders must stay nimble. Long-term holders should keep diversification and valuation discipline front and center. On October 1, 2025, the next weeks could set the tone for markets through year-end.

Frequently Asked Questions (FAQs)

Why is gold rallying even though some say stock markets are strong?

On October 1, 2025, gold rose as investors feared risks and expected Fed rate cuts. Lower yields and a weaker dollar pushed money toward gold despite steady stock markets.

What would a Fed interest rate cut do to stocks and gold?

A Fed cut lowers borrowing costs and supports growth stocks. It also reduces real yields, making gold more attractive. Both assets can benefit, though reactions depend on market expectations.

Is gold always a safe hedge when stocks falter or markets become volatile?

Gold is often a safe option, but not perfect. In sharp crashes, it can also drop. Yet over time, gold usually recovers faster and helps balance portfolios.

Disclaimer: