- Meyka AI's Newsletter

- Posts

- Heads Up: Fed Rate Decision Could Shake Dow, S&P 500, Nasdaq Futures

Heads Up: Fed Rate Decision Could Shake Dow, S&P 500, Nasdaq Futures

Volatility looms as the Fed’s next move tests Wall Street’s nerves

Table of Contents

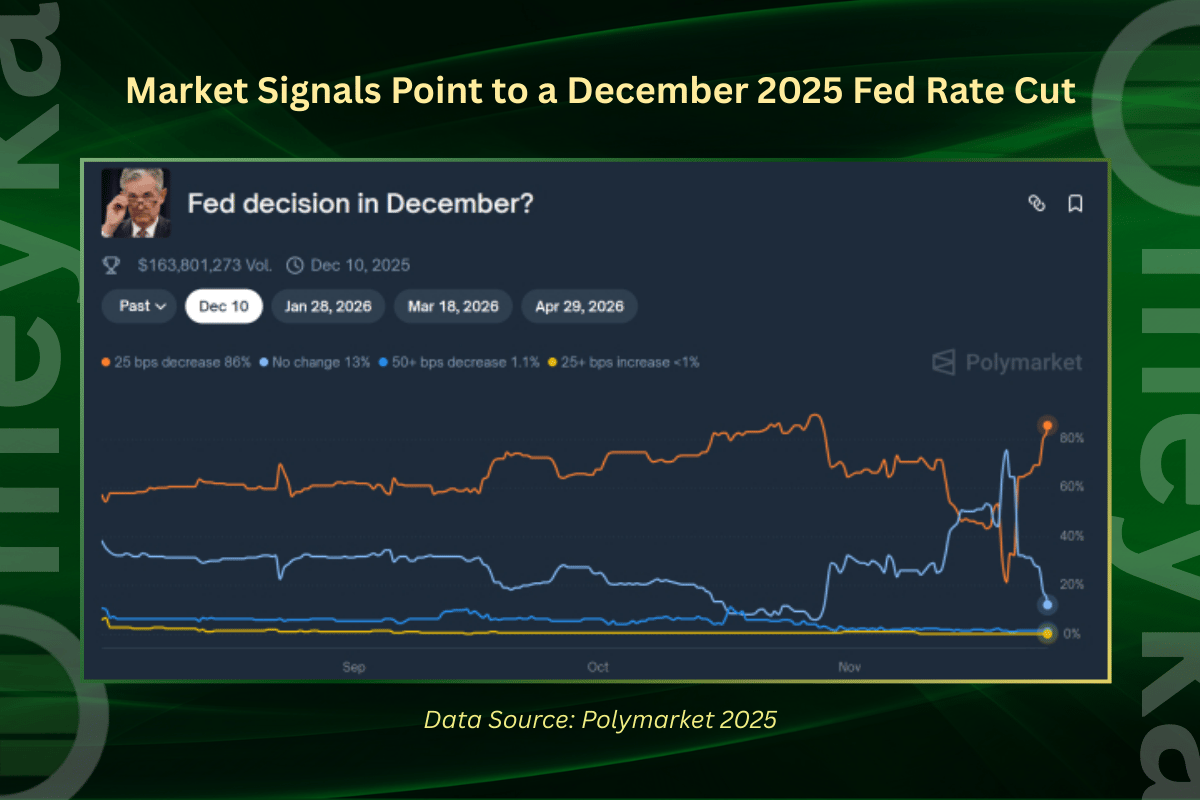

On December 10, 2025, the Federal Reserve (Fed) will announce its next interest-rate decision. Markets are on edge. Futures tied to the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite are swinging as traders brace for possible shockwaves.

It matters. A rate cut or even a hint about future moves could send growth stocks surging. Or it could spook investors if the Fed signals caution.

This Fed call is not routine. Inflation is still sticky. Job numbers are mixed. And economic data have been scattered after recent government delays. That means uncertainty and volatility may be higher than usual.

In short, the next few hours could reshape how investors view big-cap stocks, interest rates, and global capital flows. Stay tuned.

Why Today’s Fed Decision Is Not “Business as Usual”?

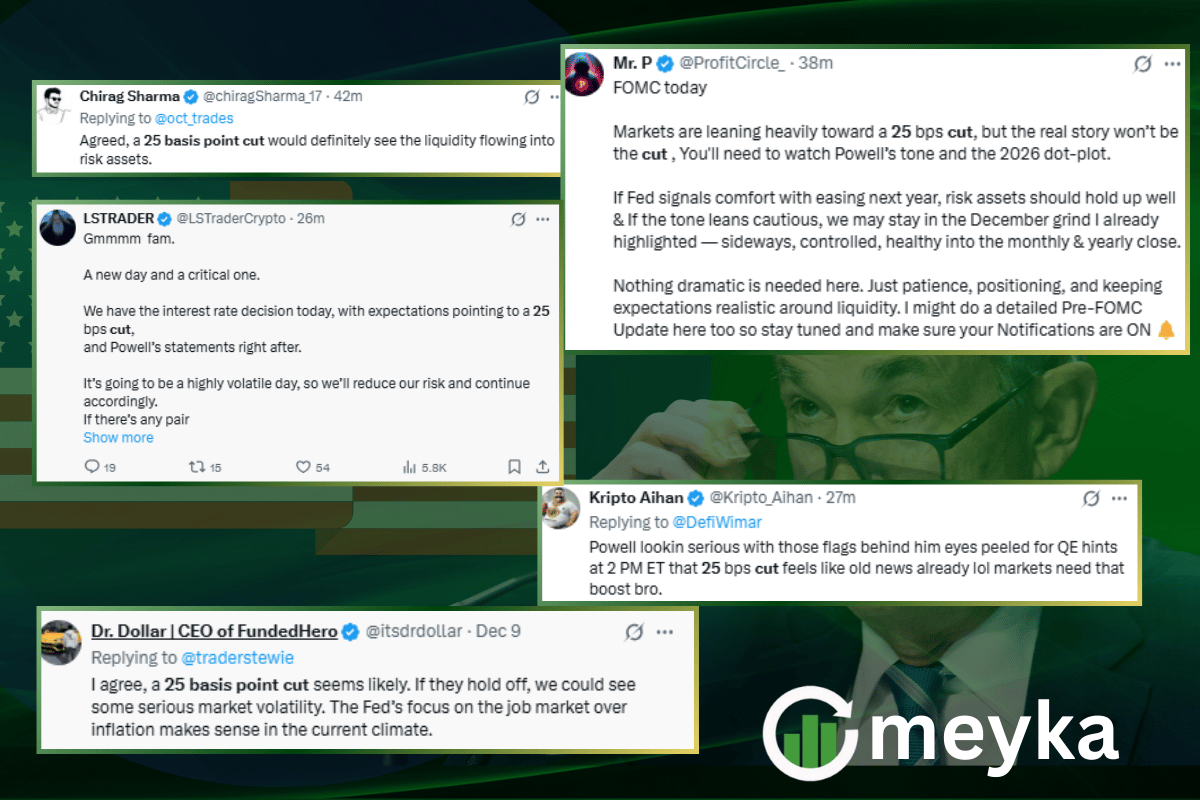

The Federal Open Market Committee meets on December 10, 2025, with markets on edge. Traders expect a 25 basis-point cut, but the debate is far from settled. Inflation has eased from its 2022 highs, yet services inflation remains stubborn. Job data are mixed. Consumer spending shows some weakening, but demand is still holding. Policymakers face a narrow path. They must avoid forcing a downturn while keeping inflation anchored. That balance makes this meeting more consequential than a routine rate call.

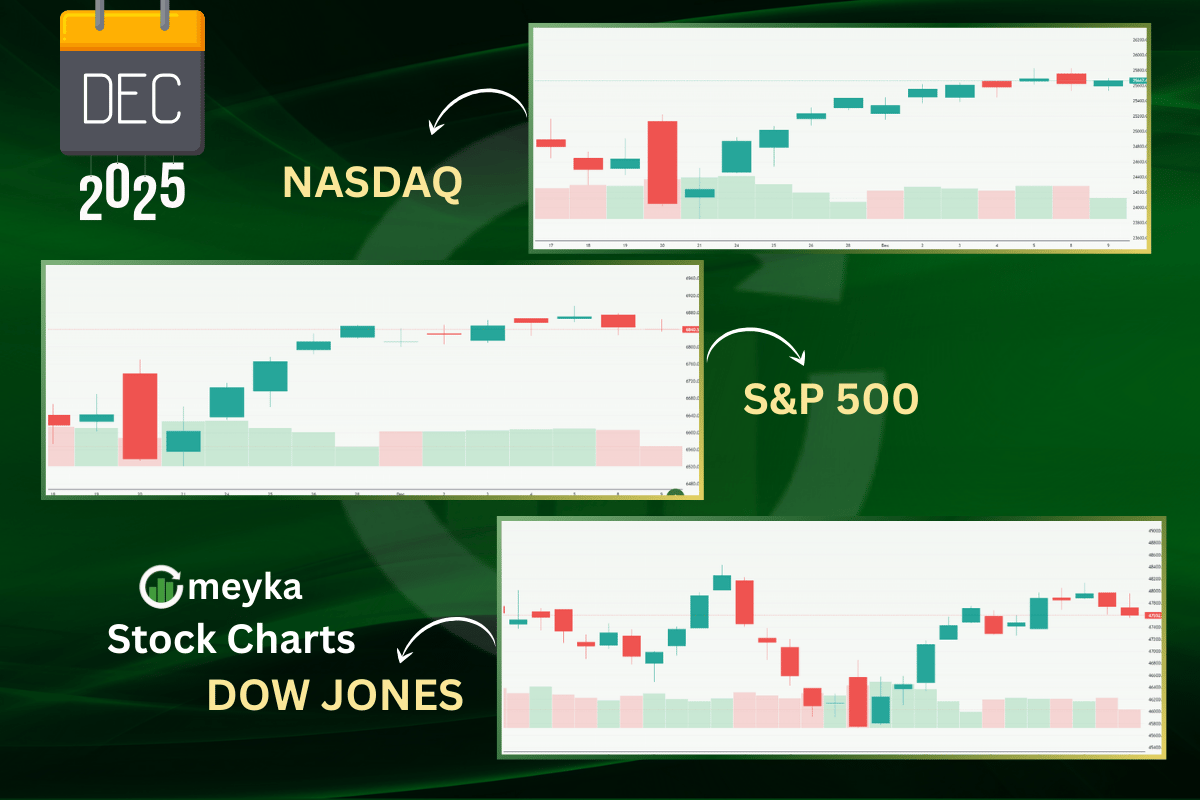

U.S. Futures at a Crossroads: Real-Time Market Setup

Futures for the Dow, S&P 500, and Nasdaq moved nervously into the Federal Open Market Committee (FOMC) window. On December 3, 2025, for example, Dow futures rose about 65 points (≈ 0.14%), while S&P 500 futures hovered nearly flat and Nasdaq-100 futures dipped under 0.1%. That mild lift still felt tentative. Many funds hedged positions ahead of the decision.

Volatility gauges also changed as the implied volatility for the S&P 500 spiked, reflecting uncertainty. Interest-sensitive growth stocks were most reactive. Since their value depends heavily on future earnings, even a small move, such as a 40-basis-point rise in Treasury yields, can lower their valuations over time.

What Wall Street Is Quietly Pricing In?

Market odds show an elevated probability of a quarter-point cut. Fed funds futures priced this path into markets well before the announcement. Treasury yields signaled investor expectations. The two-year yield, which tracks monetary policy bets closely, shifted with every rumor and data release. The yield curve also flashed caution to some strategists. If the Fed cuts and signals more easing, risk assets may get a fresh leg up. If guidance turns cautious, markets could retrace gains fast.

Who Wins / Who Loses Depending on Fed Tone?

A dovish tone would lower short yields. That tends to lift high-multiple tech names. Growth stocks often rally when real yields fall. Banks and insurers may lag in that scenario. A neutral tone usually produces choppy markets. Investors rotate into defensive names. A hawkish surprise can trigger a broad sell-off. High-beta and small-cap names suffer most in that event. Energy and staples generally show relative strength during risk aversion. Sector moves can be fast and steep.

Key Signals Investors Should Track During the Announcement

Pay attention to the dot plot for clues on the longer path. Listen to how Chair Powell frames the labor market. Watch for any hint of balance sheet plans or quantitative tightening. Track the two-year and ten-year yields for instant reaction. Monitor VIX futures for sudden spikes in fear. Follow dollar moves because a stronger dollar can dent multinational earnings. Also, watch real-time option flows for early signals of positioning. Some traders use an AI tool to parse that flow quickly.

Big Tech’s Pressure Point

X Source: Nvidia Best-Managed Company 2025 by WSJ

Mega-cap tech names now carry huge weight in the S&P 500 and Nasdaq Composite indexes. Their valuations count heavily on future growth. Rising real interest rates hurt those long-term profits first. Even a small climb in yields can cut forward earnings multiples sharply. For example, as of December 9, 2025, markets priced in an 89% probability of a rate cut but still reacted nervously.

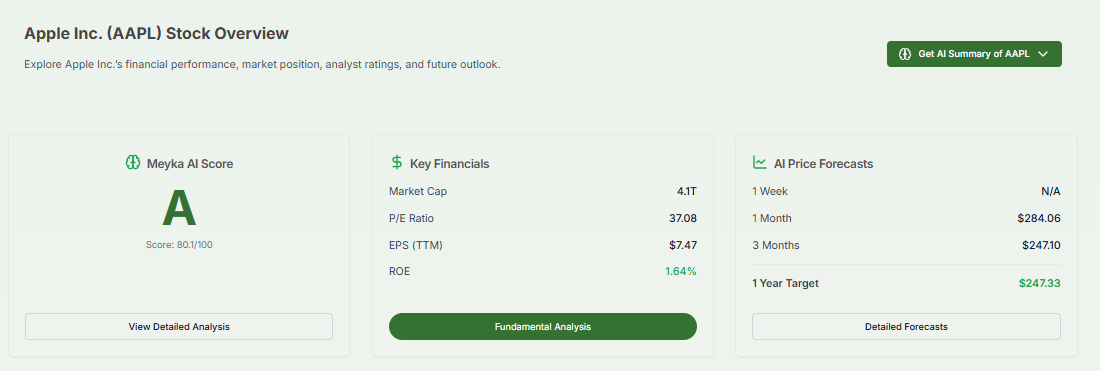

Meyka AI: Apple P/E Ratio with Market Cap Overview, December 2025

Some of these tech giants remain powerful. Nvidia recently topped a “best-managed companies” ranking. Apple has maintained a high forward P/E ratio of 32, despite volatility. Still, rate moves can overwhelm even strong earnings. When yields rise, investors demand more near-term return. That weakens price support for high-growth names. Watching how Nvidia, Apple, and Microsoft respond after the next Fed decision will show how much risk appetite remains in tech and hint at the broader market mood.

Retail Traders vs. Institutions: Who’s Positioned Better?

Institutions often enter the meeting with layered hedges. They use options and futures to blunt shock risk. Retail traders sometimes chase volatility. That can lead to concentrated bets in a handful of names. Retail flows can magnify moves in single stocks on a given day. Institutional desks watch this behavior and adjust liquidity provision accordingly. The gap between smart-money positioning and retail bets can widen post-FOMC, creating rapid price swings.

Expert Sentiment: Bulls and Bears Split

Market strategists are divided. Bulls point to easing inflation and a resilient economy as reasons to buy dips. Bears warn that the market has priced in too much easing too soon. Both camps cite credible data. Bulls emphasize steady household balance sheets and corporate cash. Bear's note sticky services inflation and geopolitical risks. The split matters because it makes price action reactionary. Any nuance from the Fed can tip the balance quickly.

Final Market Prep for Readers

Trim leverage before the press conference. Hold cash for strategic re-entries after the initial move. Use short-dated hedges if downside protection is a priority. Focus on liquidity when taking new positions. Watch post-announcement reversals; initial moves often reverse within hours. Keep an eye on the yield curve and dollar as second-order risk drivers. Avoid making major allocation shifts based only on headlines. Let price action provide confirmation.

Frequently Asked Questions (FAQs)

How will the Fed rate decision move U.S. stock futures?

On December 10, 2025, the Fed rate decision may create fast moves in Dow, S&P 500, and Nasdaq futures. Traders react to interest changes. Up or down depends on guidance.

Which stocks react most to Fed rate cuts?

Tech and growth stocks react strongest to rate cuts. These companies rely on future profits. Lower rates help their value. But other sectors may not rise as fast.

What should traders watch during the Fed press conference?

Traders watch the dot plot, interest rate comments, and U.S. bond yields. They also track market fear signals, like VIX. Words from the Fed chair move prices fast.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.