- Meyka AI's Newsletter

- Posts

- LG Taps FuriosaAI Over NVIDIA: Chip Sector Pullback Hits NVIDIA Shares 2.5%

LG Taps FuriosaAI Over NVIDIA: Chip Sector Pullback Hits NVIDIA Shares 2.5%

A bold chip shift by LG signals rising competition in AI hardware, and investors are taking notice.

Table of Contents

Did you know LG just made a bold move in the AI chip world? Instead of choosing NVIDIA, the global giant, LG picked a rising South Korean startup, FuriosaAI.

This decision surprised many in the tech world. Why would a major company like LG skip over a trusted name like NVIDIA? And what does this bring for the chip industry?

In just one day, NVIDIA’s shares dropped by 2.5%. That’s a big hit for such a strong player. We’re starting to see a shift. More tech companies want local or cost-friendly options. Countries are also pushing for self-reliance in chipmaking. LG’s move might be the first of many.

Let’s break down what happened, who FuriosaAI is, and how this change could impact the future of AI chips.

LG’s Strategic Shift

In July 2025, LG AI Research surprised many by choosing FuriosaAI’s RNGD accelerator over NVIDIA GPUs for its EXAONE large language model. LG’s decision came after a seven-month review that tested speed, latency, and energy use.

We’re witnessing a bold move driven by the need for more efficient, cost-effective AI infrastructure. LG aims to deploy this technology across smart devices, internal AI services, and even to external clients.

Who is FuriosaAI?

FuriosaAI is a Seoul-based startup founded in 2017 by former Samsung and AMD engineers. Its flagship chip, RNGD (“Renegade”), uses a custom Tensor Contraction Processor architecture built on TSMC’s 5nm process with dual HBM3 memory.

FuriosaAI has claimed that RNGD delivers up to 2.25× better inference performance per watt than traditional GPUs. The startup even rejected an $800 million acquisition offer from Meta earlier this year, which signals confidence in its independence and vision.

Impact on NVIDIA

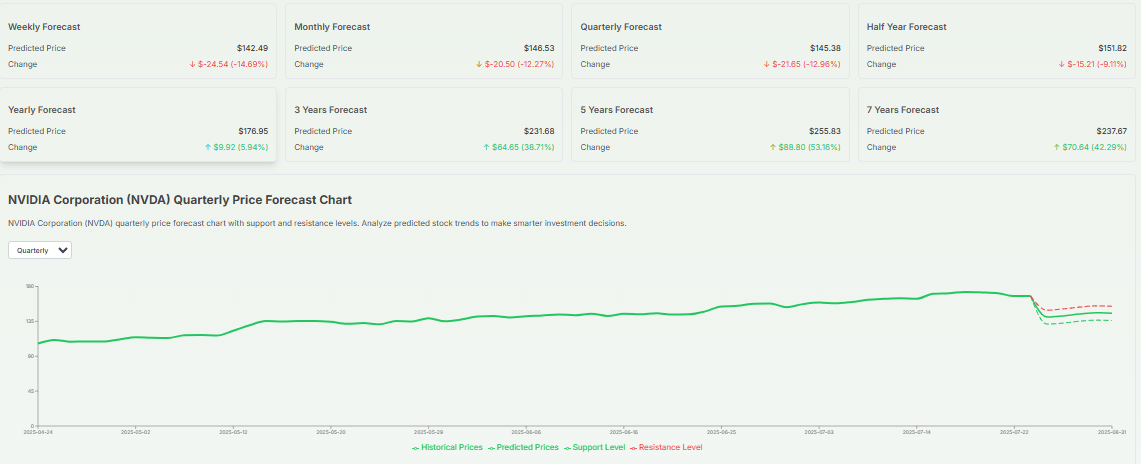

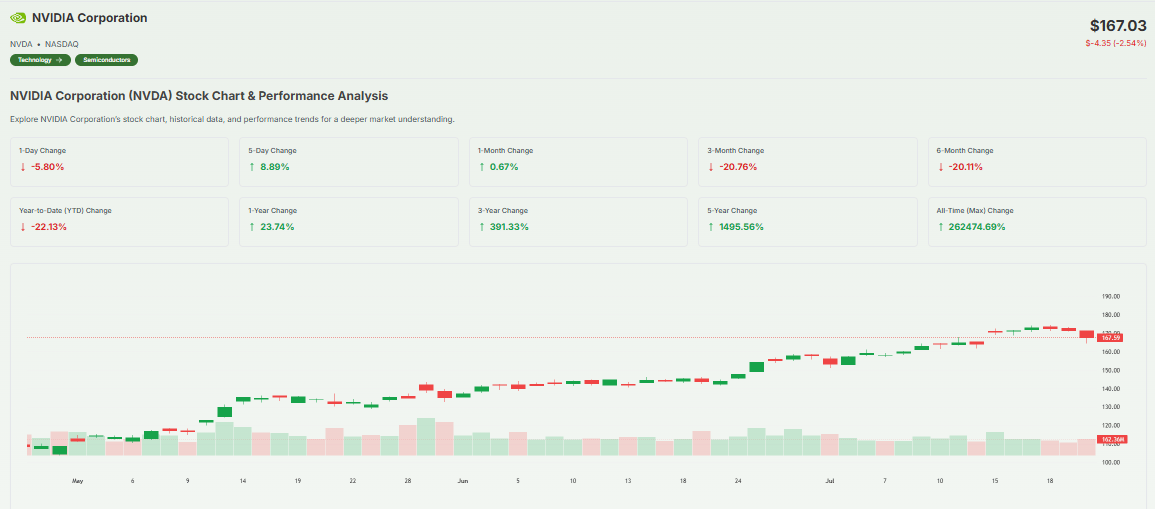

NVDA Chart on Meyka AI: A tough day for Nvidia shares, dipping 2.5% as chip market cools off.

Shares of NVIDIA fell around 2.5% on the news, and reflect investor concerns about competition and shifting demand. While NVIDIA still leads the AI chip market, LG’s vote of confidence in a rival shows that the monopoly is weakening. This shift highlights the sensitivity of NVIDIA’s stock to client losses and catalyst events.

Broader Chip Sector Pullback

LG’s partnership comes amid a wider pullback in chip stocks. Rising interest rates, cooling AI demand, and geopolitical tensions between the US and China have dampened investor optimism. Major chipmakers like AMD and Intel have also faced pressure as growth forecasts slow and supply chains stabilize.

LG’s move is both a symptom and a signal of this broader trend, challenging assumptions that GPU-backed growth is unshakeable.

The Race to Rule AI Chips

AI Chip Battle

NVIDIA’s dominance over 80% or more of the AI chip market is now being challenged. Companies like Groq, Cerebras, SambaNova, and regional players like Tenstorrent and Alibaba’s Xuantie are stepping onto the scene.

FuriosaAI stands out because RNGD was built specifically for AI, unlike GPUs which are general-purpose. Tests at LG show its energy efficiency and lower total cost of ownership make it viable for inference workloads.

Why Does This Move Matter for LG and South Korea?

LG’s choice aligns with South Korea’s drive for self-reliance in tech. By opting for a domestic chip startup, LG boosts local innovation and strengthens South Korea’s AI and semiconductor ecosystem. FuriosaAI, backed by Samsung and SK Hynix talent, gains validation and momentum. LG's move may inspire other Korean companies to prioritize homegrown AI chip solutions.

What Investors Need to Know Now?

For investors, this signals rising competition to NVIDIA, with new players capable of displacing a share of GPU demand. We’ll be watching NVIDIA’s next earnings call and any further losses of key clients.

On the flip side, any further deals for FuriosaAI, especially in the U.S., Middle East, or Southeast Asia, could boost its stock value and credibility. Also key will be government policies supporting chip independence in South Korea and other tech-forward nations.

Wrap Up

LG’s decision to choose FuriosaAI over NVIDIA is a big moment in the AI chip world. It shows that even tech giants are open to trying newer, more local options. This isn’t just about cost, it’s about performance, power savings, and long-term strategy.

NVIDIA is still strong, but this move proves that its place at the top isn't guaranteed. Startups like FuriosaAI are ready to challenge the old leaders with smarter and faster solutions.

For South Korea, this is a win. It boosts local innovation and supports the country’s goal of being a leader in AI tech.

As more companies rethink their chip choices, we may see a major shift in the market. And as always, we’ll be watching what happens next.

Frequently Asked Questions (FAQs)

Why can't China buy Nvidia chips?

China is still banned from buying Nvidia’s most powerful chips. But in July 2025, the U.S. allowed some weaker chips, like the H20, to be sold again.

Who are they competing with?

FuriosaAI competes with big names in AI chips like Nvidia, AMD, Groq, SambaNova, Cerebras, and others, offering inference and reasoning accelerators.

What is FuriosaAI’s vision?

FuriosaAI aims to lead the next generation of AI computing by building fast, energy-efficient chips that power AI everywhere from data centers to smart devices.

What is the valuation of FuriosaAI?

FuriosaAI has raised around $52M to $115M in funding so far. It rejected an $800M acquisition offer, implying a valuation below Meta’s bid (~$800M) but well above its funding total.

Disclaimer: