- Meyka AI's Newsletter

- Posts

- MEYKA AI Weekly Outlook: Nasdaq Futures Jump as Markets Brace for Fed Signals and Megacap Earnings

MEYKA AI Weekly Outlook: Nasdaq Futures Jump as Markets Brace for Fed Signals and Megacap Earnings

On January 28, 2026, Nasdaq futures climbed sharply as U.S. markets opened the week with strong tech momentum. Traders drove the tech‑heavy index higher. This rise came as investors waited for the Federal Reserve’s first policy decision of the year and prepared for a key round of earnings from the biggest technology companies. Markets reacted to optimism around artificial intelligence and solid gains in chip stocks. At the same time, traders watched the Fed for clues about interest‑rate direction.

Big tech earnings from names like Microsoft, Meta and Tesla are expected to shape market direction later in the week. The mix of Fed signals and megacap earnings has created sensitivity in markets. Many investors see this week as a vital turning point. Their moves now could influence where stocks head next.

Nasdaq Futures Rise: Market Momentum and Tech Gains This Week

Markets showed strong momentum as Nasdaq futures climbed sharply on January 28, 2026. Investors pushed tech-linked contracts higher ahead of key events this week. Futures for the Nasdaq 100 rose about 0.8%, while S&P 500 futures also gained ground. The Dow Jones futures stayed near flat. These moves followed a run of solid gains that pushed the S&P 500 to fresh record levels in the prior session.

Tech names led the advance, with chip stocks like Nvidia and Intel climbing in pre-market trading. Other semiconductor players, including Micron and Microchip Technology, also posted healthy gains. This broad strength in tech helped lift optimism in markets as traders prepared for a packed week of corporate results and central bank guidance.

Meyka AI: U.S. Tech Sector Performance Current Overview, January 28, 2026

Why are Nasdaq Futures Rising?

The strength in futures shows how traders are positioning ahead of the Federal Reserve’s rate decision and heavy earnings flow from megacap firms. The tech sector’s resilience has been central to this move. Market breadth remained strong, with many tech and AI-linked stocks outperforming even as some other sectors struggled.

Impact of Fed Signals on Stock Market Trends

This week’s trading is heavily influenced by investor focus on the Federal Reserve’s first policy decision of 2026. The Fed is widely expected to hold its key interest rate steady in a 3.5% to 3.75% range on January 28, 2026.

Fed Guidance Over Interest Rates

Markets now look past the rate number to the language the Fed uses about the future of monetary policy. Traders are watching closely for shifts in the Fed’s tone regarding inflation, growth, and interest-rate expectations. A more dovish stance could fuel additional gains in growth-sensitive stocks, especially in the tech space. A more cautious message, on the other hand, could cool some of the recent optimism.

Broader Economic Signals to Watch

The policy setting comes amid broader economic signals that show consumer confidence near multi-year lows and currency movements that reflect shifting risk sentiment. This mix has made the Fed’s guidance even more crucial for traders. The market’s reaction to the Fed could set the tone for positioning into the earnings season.

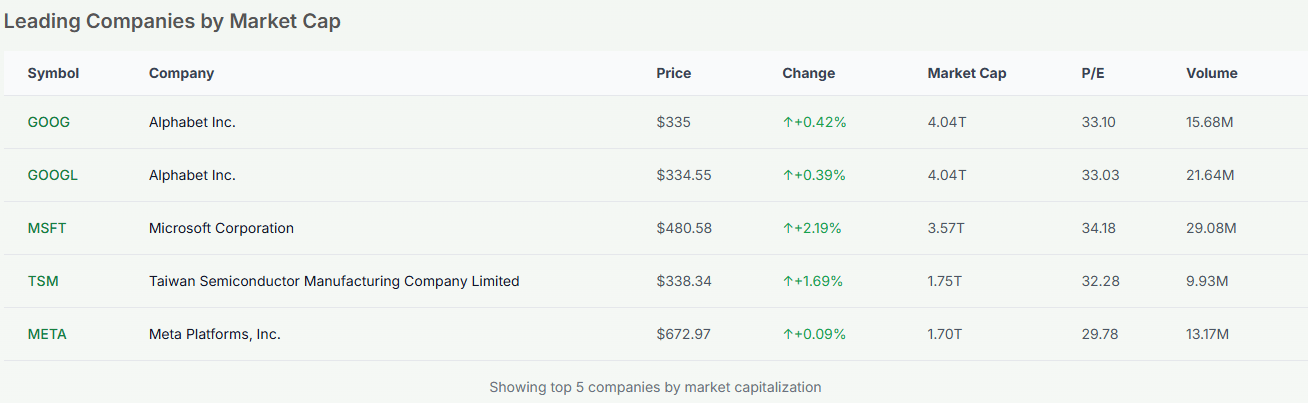

Mega-Cap Tech Earnings Outlook: Microsoft, Meta, Tesla

This week marks a crucial point in the corporate earnings calendar, with several megacap technology companies scheduled to report results. Names like Microsoft, Meta, and Tesla carry significant weight in the indexes and are expected to be key drivers of sentiment.

Meyka AI: Top Global Tech Companies by Capitalization

AI and Cloud Revenue Growth in Focus

Investors are not only looking at top-line results but also at how these firms are growing revenues tied to artificial intelligence and cloud services. Tech stocks have enjoyed strong performance from broad AI-related demand and upbeat forecasts in recent months. Many analysts see AI investment as a major long-term growth theme for corporate profits this year.

Earnings as a Market Test

These earnings releases are the first major test of whether that narrative is translating into actual reported results across the biggest tech names. A strong set of results could keep the momentum going, while weaker reports might prompt rotation out of richly valued growth names.

In pre-market trading, some chip and tech hardware stocks like Nvidia have already shown gains ahead of their own results, which often act as bellwethers for the broader tech cycle. This has helped support futures and boost confidence that the earnings picture may reinforce recent market strength.

Key Market Indicators Traders Should Watch

As the week unfolds, three key catalysts will shape market direction:

Federal Reserve Policy Commentary

Beyond holding rates steady, the Fed’s communication about inflation and economic growth will be under the microscope. Markets are sensitive to even subtle shifts in language that could hint at future rate cuts or risks.

Tech & AI Earnings Execution

Results from megacap companies are critical. Investors will weigh not just earnings beats, but also guidance on future revenue growth and spending on new technologies.

Market Breadth & Sector Rotation Signals

Traders will watch whether strength remains concentrated in tech or begins to spread to other sectors. Indicators like small-cap performance, bond yields, and volatility indexes could provide clues about broader market sentiment.

Forward View: What to Expect from Global Markets

This week’s events could be a turning point for market leadership. If the Fed’s guidance and corporate earnings align with investor expectations, tech and growth stocks may continue to push indexes higher. Divergences between earnings results and policy signals could widen market moves and create short-term volatility.

Either way, the events of January 28-29, 2026 will be widely studied for clues about how markets will navigate the balance between monetary policy and real earnings growth in the months ahead.

Final Words

This week is shaping up as a key test for markets. Success in AI-driven growth and solid corporate results may keep optimism alive, while cautious Fed language or earnings misses could trigger rotation. January 28-29, 2026, could set the tone for equity leadership in the weeks ahead.

Frequently Asked Questions (FAQs)

Why are Nasdaq futures rising?

Nasdaq futures are rising on January 28, 2026, as investors expect strong tech earnings and AI growth. Traders hope these gains will continue if corporate results meet expectations.

How will the Fed decision affect stocks?

The Fed’s decision on January 28, 2026, may change interest rates or guidance. Lower rates could boost stocks, while cautious language may slow growth, affecting market confidence.

Which tech earnings will move the market?

Earnings from Microsoft, Meta, and Tesla on January 28-29, 2026, are likely to move the market. Strong results may lift tech stocks, while weak reports could cause a pullback.

Disclaimer