- Meyka AI's Newsletter

- Posts

- MEYKA Market Pulse: Dow, S&P 500 & Nasdaq Futures Pause Ahead of Bank Earnings and Key Tariff Decision

MEYKA Market Pulse: Dow, S&P 500 & Nasdaq Futures Pause Ahead of Bank Earnings and Key Tariff Decision

Markets pause, uncertainty rises, big moves could come next

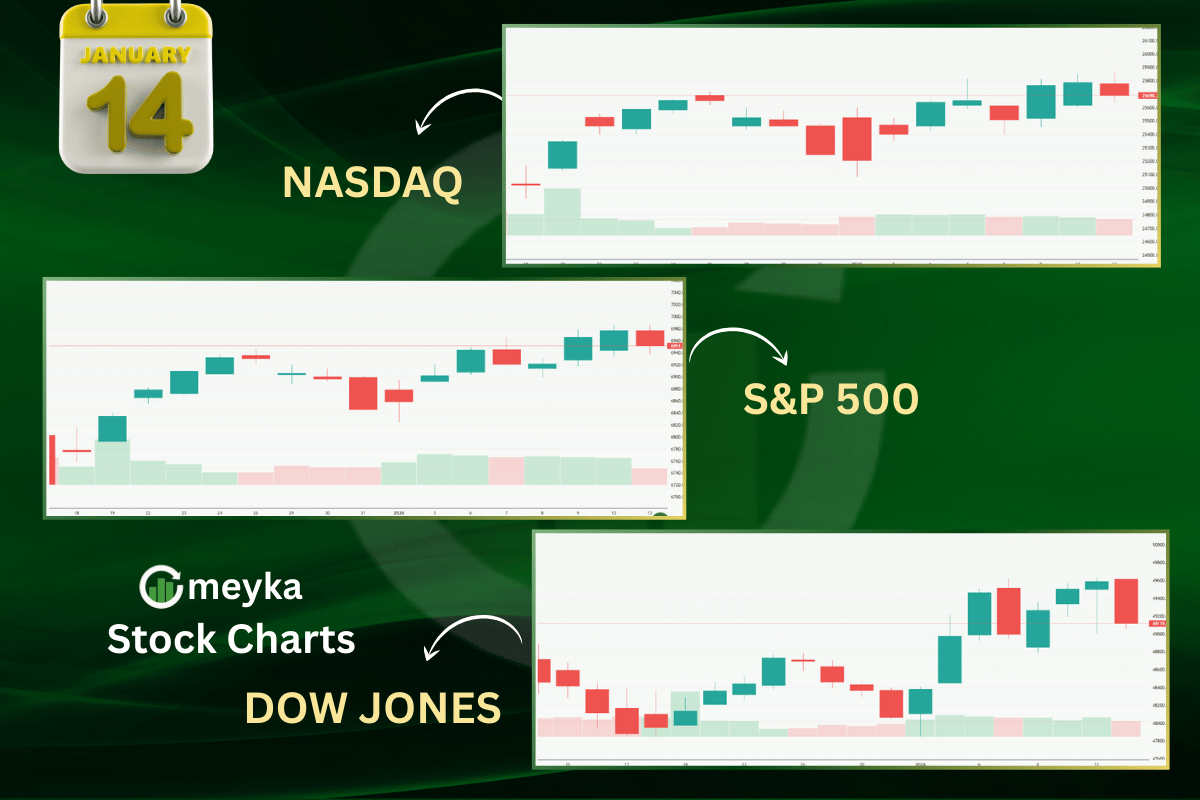

U.S. stock futures are taking a breather today. As of Tuesday, January 14, 2026, Dow, S&P 500, and Nasdaq futures are moving in a narrow range. The pause comes after a strong start to the year. Investors are not rushing. They are waiting.

Two big triggers are in focus. First, major U.S. banks are releasing earnings this week. These results often set the tone for the wider market. Banks reflect credit demand, consumer strength, and business confidence. Even small surprises can move futures fast.

Second, a key tariff decision is approaching. This ruling could shape trade policy and costs for global companies. Markets dislike uncertainty. That is why traders are cautious, not bearish.

Volume is lighter than usual. Futures show hesitation, not fear. This signals a wait-and-watch mood across Wall Street.

For now, markets are pricing in risk, not direction. The next move depends on facts, not guesses. Earnings numbers and policy signals will decide whether this pause turns into a breakout or a pullback.

US Stock Market Futures at a Crossroads: Technical & Sentiment Snapshot

On January 14, 2026, stock index futures exhibited minimal movement prior to key events. Meyka Analysis shows Dow futures were down about 0.2-0.3%, S&P 500 futures slipped roughly 0.2%, and Nasdaq 100 futures also declined near 0.2% as traders stayed cautious ahead of bank earnings and a major tariff decision.

This lack of direction reflects a market in wait-and-see mode. After strong finishes that lifted benchmarks to record highs, futures are not trending strongly in either direction. Instead, they trade flat or slightly lower as investors adjust to recent mixed data.

Traders are sizing up both economic indicators and corporate earnings. Inflation readings and jobs data could sway expectations for interest rates. Mixed signals on inflation have kept bets on Federal Reserve rate cuts alive into mid-year.

This careful stance points to neutral sentiment rather than outright risk-off positioning. Markets often pause ahead of clear catalysts, and that is the case now, with price action lacking conviction until fresh data arrives.

The Bank Earnings Galvanizer: Meyka Review

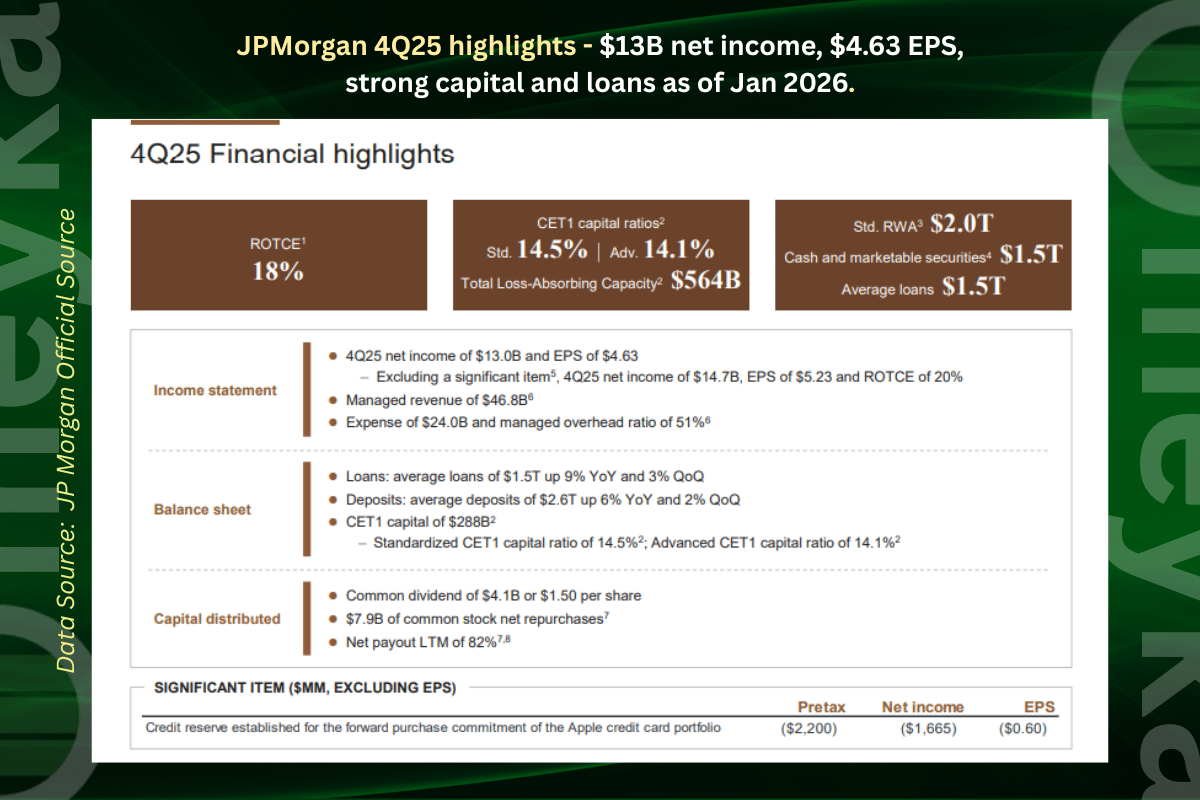

On January 13, 2026, JPMorgan Chase reported its fourth‑quarter 2025 earnings. The bank posted net income of about $13 billion, and revenue rose roughly 7 % to around $46.8 billion year‑over‑year. On a per‑share basis, earnings came in at $4.63, slightly below some forecasts, but adjusted earnings per share were $5.23, beating many analyst estimates. These mixed results helped explain why the stock dipped even after stronger revenue figures.

JPMorgan beat some estimates, yet its shares dipped after warnings about credit-card interest

rate caps and economic headwinds. That pushed broader financial stocks down and weighed on the Dow and S&P 500.

For the upcoming sessions on January 14, 2026, Bank of America, Wells Fargo, and Citigroup were scheduled to report Q4 results before the market opened. Analysts expected Bank of America to earn about $0.95-$0.96 per share on roughly $27.7-$27.8 billion in revenue, Wells Fargo to report around $1.66-$1.69 in EPS on about $21.6 billion in revenue, and Citigroup to report around $1.61-$1.77 EPS with revenue near $20.5-$21 billion.

Investors now watch not just profits but forward guidance. Firms’ projections can matter more than quarterly numbers if executives signal slowing demand or rising costs. Earnings week could be the first real test of whether optimism from early 2026 holds.

US Tariff Decision: Market Implications & Uncertainty

A Supreme Court ruling on tariff powers looms large for trade policy and market confidence. The court’s decision could arrive around January 12-16, 2026, but timing remains uncertain.

The core issue is whether the executive branch has the authority to impose broad tariffs under emergency law. This ruling could reshape trade rules and affect companies reliant on global supply chains.

Uncertainty itself has been priced into markets. Without clarity, firms hesitate on inventory planning, capital investment, and pricing strategies. Retailers and manufacturers could be especially vulnerable to tariff shifts.

Options markets are already signaling expectations for sharp moves. Analysts see potential swings of nearly 1% in the S&P 500 on a strong ruling day, either up or down depending on the outcome.

A ruling curbing tariff authority might relieve trade pressure and ease costs for import-dependent firms. Alternatively, a decision upholding tariffs could extend protectionist policy and keep cost uncertainty in place. The market impact will be immediate and likely broad.

US Stock Market Performance: Cross-Asset Signals & Macro Themes

On January 14, 2026, U.S. inflation data showed a 2.7% yearly rise in the Consumer Price Index (CPI) for December, with a 0.3% monthly gain. Core inflation, excluding food and energy, climbed around 2.6% year‑over‑year. This steady but moderate pace suggests inflation is cooling slowly, supporting views that the Federal Reserve may hold rates unchanged at its next meeting and consider cuts later in mid‑2026 if price pressures ease further.

This development shapes more than just stocks. According to Meyka research, Treasury yields dipped modestly as traders priced in a potential pause or future rate cuts, hinting at softer growth expectations. Meanwhile, precious metals like gold edged toward record highs as investors sought safety amid mixed signals from markets.

In currency markets, the U.S. dollar weakened slightly after the inflation report, reflecting relief that prices did not surprise to the upside and reducing the odds of further rate hikes this quarter. Meyka tracking indicates a weaker U.S. dollar could boost multinational earnings but raise import costs.

Meyka AI: US Dollar Index (DX-Y.NYB) Index Overview

Supply chains and production costs remain under watch. Trade policy uncertainty, including tariffs, can shift costs for materials and components, making some sectors more volatile than others. These forces are shaping futures pricing day by day as markets balance inflation trends, rate expectations, and global trade developments.

Actionable Stock Market Strategies: Dow, S&P 500 & Nasdaq Insights

The US stock market outlook remains balanced but fragile. Short-term moves hinge on incoming data and earnings surprises, while the tariff decision could spark abrupt shifts in risk appetite.

In this landscape, investors should stay alert to new information and avoid overcommitting ahead of key events. Earnings surprises and court rulings can move prices quickly. Technical trends suggest indecision, and breaking above or below recent ranges may signal broader shifts.

Monitoring sector leadership will be crucial. Financials, industrials, and tech stocks might diverge sharply based on results and policy developments. Active management and risk controls can help navigate the coming volatility.

Closing Summary & Forward Look - 2026

Stock futures may be paused, but the market’s underlying activity is building toward decisive catalysts. Bank earnings and a major tariff ruling are packed into a short window, and either could unlock fresh trends.

Investors should watch corporate reports, inflation data, and policy news to gauge direction. As markets digest these inputs, the pause could end in a clear breakout or stall further if uncertainty persists.

Stay tuned with Meyka News Updates as developments unfold and inform the next chapter of the market story.

Frequently Asked Questions (FAQs)

Why are Dow, S&P 500, and Nasdaq futures flat today?

On January 14, 2026, U.S. futures were flat as traders waited for bank earnings and a tariff ruling. Caution rose after recent gains and limited fresh economic data.

How do bank earnings impact the stock market?

Bank earnings reveal credit demand and profit trends. Strong results can lift confidence across markets, while weak guidance often pressures stocks by raising concerns about growth and financial stability.

What is the tariff decision, and why does it matter for stocks?

The tariff decision determines how easily the government can impose trade duties. In 2026, this matters because tariffs influence costs, inflation expectations, and corporate earnings across global markets.

Disclaimer: