- Meyka AI's Newsletter

- Posts

- Stock Market Update: S&P 500 Sets Record Close on AI Strength, GDP Data Pressures Rates

Stock Market Update: S&P 500 Sets Record Close on AI Strength, GDP Data Pressures Rates

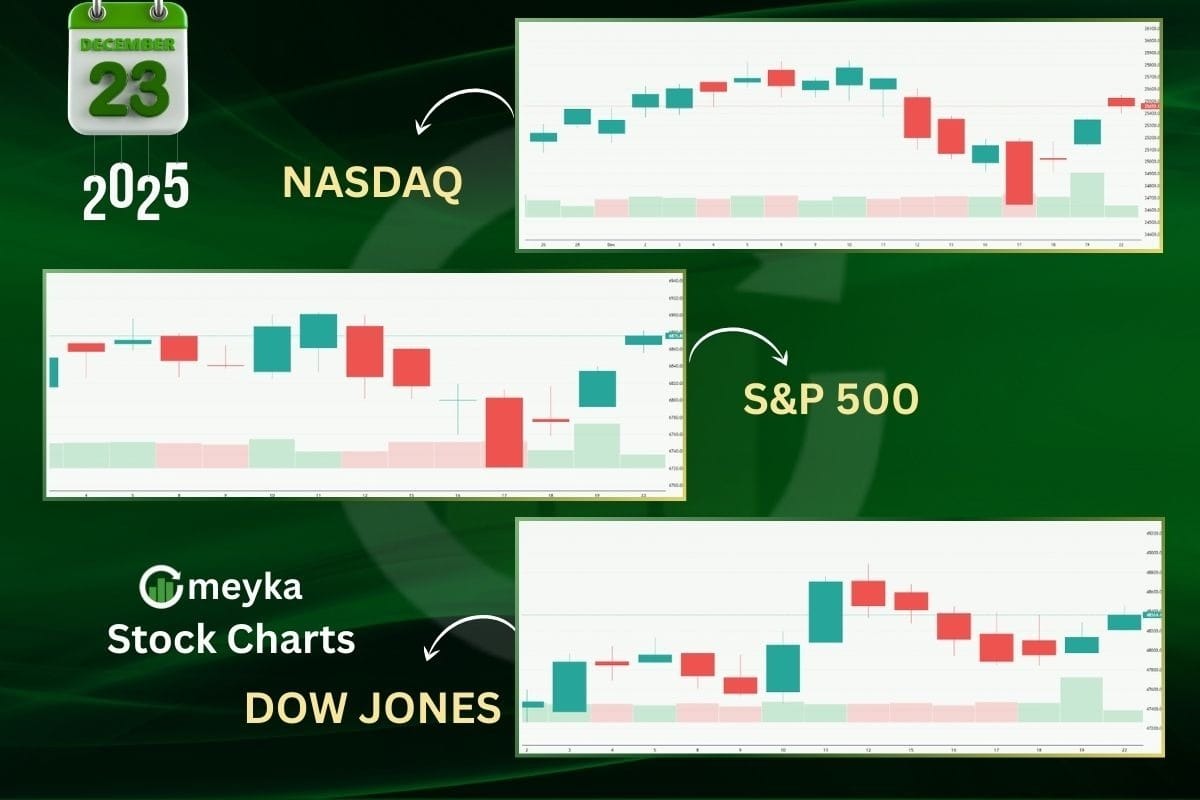

The stock market finished higher Tuesday as AI stocks lifted the S&P 500 up 0.5% to a record 6,909.79. The Dow gained 0.2% and the Nasdaq rose 0.6%, while the Russell 2000 fell 0.7%. Investors overlooked strong GDP data, Nvidia climbed, and ServiceNow slipped on a $7.75 billion acquisition plan.

On Tuesday, December 23, 2025, Wall Street ended the day on a strong note. The S&P 500 closed at a fresh record of 6,909.79, rising about half a percent. The push came from one place. Artificial intelligence stocks. Big tech names once again took the lead and pulled the broader market higher.

The rally came with a twist. New U.S. GDP data showed the economy is still growing fast. In normal times, that kind of news can worry investors. Strong growth can keep interest rates high for longer. Yet the market chose a different path. Traders stayed focused on future tech gains, not rate fears.

But the thing is, not all stocks joined the celebration. Small-cap shares slipped, and some companies faced selling pressure after big corporate moves. This split tells an important story. The market is rising, but confidence is selective.

Let’s understand why investors made these choices matters more than the numbers alone.

Where the Bulls are Winning: Tech & AI Stocks

On Tuesday, December 23, 2025, the U.S. stock market showed strong gains. The S&P 500 climbed about 0.5% to a new record of 6,909.79, led by big tech stocks. The Nasdaq rose 0.6%, while the Dow Jones gained 0.2%. Meanwhile, smaller companies lagged, with the Russell 2000 falling about 0.7%.

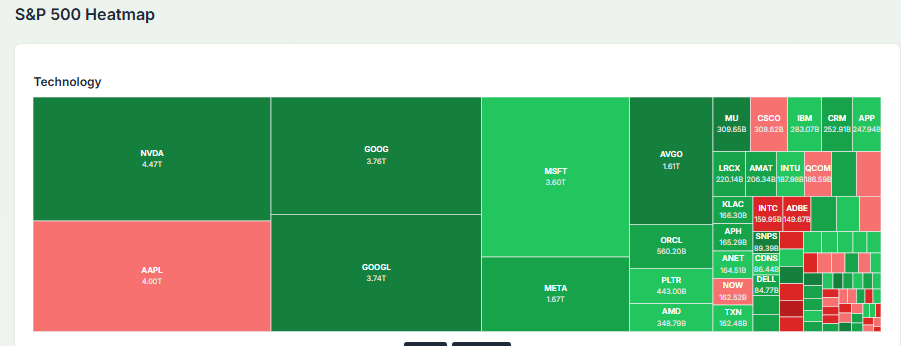

Tech stocks stole the spotlight again. Companies tied to artificial intelligence and cloud computing drove much of the upside. Nvidia and other major tech names posted solid gains as investors bet on continued demand for AI chips and software tools. This narrow leadership lifted major indexes even though many individual stocks finished lower.

Meyka AI: Technology Sector Performance Overview, December 23, 2025

Strength in tech helped push the market higher despite mixed signals from other sectors. Healthcare also contributed, with companies like Novo Nordisk jumping after positive news. But the rally’s backbone was clearly the largest tech names, showing that big stocks can move markets even when broad participation is weak.

Meyka AI: Novo Nordisk A/S (NVO) Stock Overview, December 23, 2025

The GDP Surprise That Wasn’t All Good News

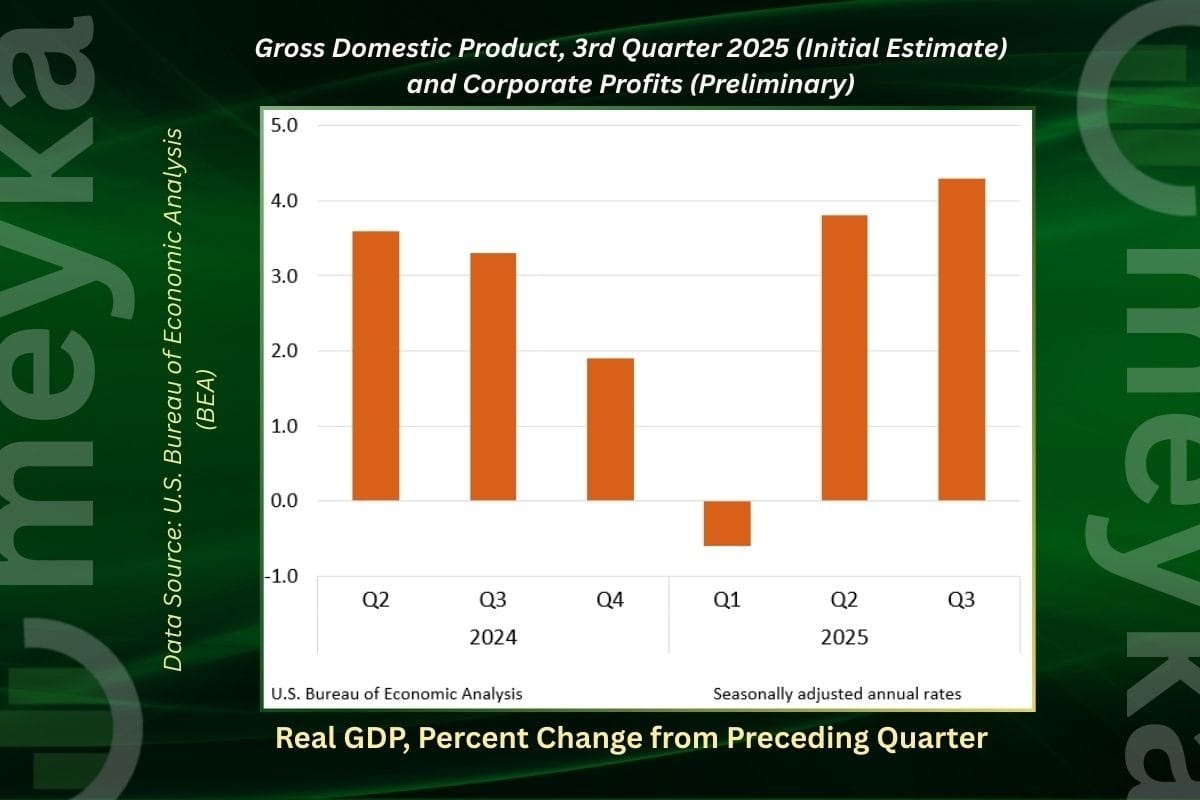

Markets also reacted to fresh U.S. economic data. The third-quarter economy grew at a 4.3% annual rate, beating expectations for around 3.3% growth. Consumer spending and services helped lift the report.

Normally, strong growth boosts confidence, but this number complicated the outlook for interest rates. Strong GDP suggests the economy is running hot. That could make the Federal Reserve less likely to cut rates soon. Investors often rally on rate cuts because cheaper borrowing can lift stock prices. In this case, the strong data pushed markets up even as it reduced near-term hopes for rate relief.

This contrast shows how markets can respond to the same data in different ways. Stocks climbed because growth reassures investors about company profits. But stronger growth also means a slower path to lower rates, which can dampen investor enthusiasm in other parts of the market.

Small-Cap Stocks Tell a Different Story

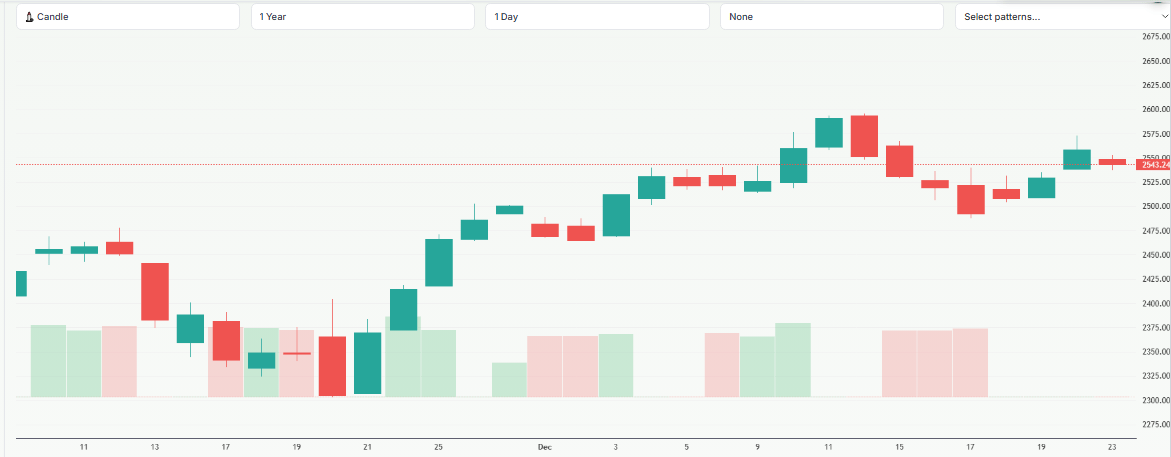

While big indexes hit fresh highs, not all parts of the market participated. The Russell 2000, a measure of small companies, declined about 0.7% on December 23, 2025.

This difference matters. Rising major stock indexes driven by a handful of giant tech names can mask weakness in smaller stocks. In this case, strong gains in big tech helped the S&P 500 and Nasdaq close higher even though many smaller companies fell.

Meyka AI: Russell 2000 (^RUT) Index Overview, December 23, 2025

The small-cap drop suggests investors are still cautious about broader economic risks. Smaller businesses are often more sensitive to borrowing costs, slower sales, and weaker demand. Their underperformance may signal that the market’s strength is not uniform, and risks still exist below the surface.

Corporate Headlines: Nvidia, ServiceNow & Sector Moves

Major tech names had mixed results on December 23, 2025. Nvidia continued to climb, helping lift the tech sector’s overall performance. Gains in chip makers and cloud computing firms showed that AI and related tech remain investor favorites.

At the same time, ServiceNow slipped after announcing a $7.75 billion acquisition of cybersecurity firm Armis. Some investors viewed the deal as a strategic move to strengthen long-term growth. Others were wary of the cost and integration risk. This reaction pulled down software stocks in the tech index.

Meyka AI: Healthcare Sector Performance Overview, December 23, 2025

Healthcare also contributed to market action. Novo Nordisk jumped sharply on news that U.S. regulators approved its oral obesity drug. This kind of positive catalyst shows that sectors outside tech can still move markets when news is strong.

Macro Risk Factors to Watch

Despite the rally, not all signals are upbeat. The strong GDP report complicates expectations for Federal Reserve policy. High economic growth can keep interest rates higher for longer, which tends to tighten financial conditions.

Investor confidence is high going into 2026, with markets rallying and volatility gauges falling. But some analysts warn that this confidence may overlook risks like rising inflation or slowing sectors. Too much optimism can make markets fragile when surprises hit.

This is a time to watch upcoming inflation data, employment reports, and any Federal Reserve remarks closely. These factors will influence whether markets stay elevated or correct after strong gains.

US Market Moves: What This Means for Investors?

The market’s recent action shows a mix of strength and caution. Broad indexes hit records, led by big tech and AI-linked stocks. However, weaker performance in smaller stocks and uncertainty about rate cuts remind investors that gains are not universal.

Investors should consider how concentrated gains are. A portfolio heavy in major tech stocks may benefit from strong growth trends. But diversifying into other sectors, including value areas or small caps, might reduce risk if leadership shifts.

Watching macro data remains crucial. Inflation and labor trends will shape rate expectations and, in turn, market direction. Keeping an eye on these signals can help navigate the mixed landscape of early 2026.

Closing Thoughts

The market closed at record levels, but the story underneath is more complex. Big technology and AI stocks continue to carry the S&P 500 higher. At the same time, small-cap stocks and rate-sensitive sectors show caution. Strong GDP growth supports earnings, yet it also delays hopes for quick interest-rate cuts.

This mix of signals suggests the rally is driven by confidence in a few powerful themes, not broad market strength. Investors are rewarding scale, cash flow, and clear growth paths. They are avoiding uncertainty.

As markets move toward 2026, attention will shift to inflation data, Federal Reserve guidance, and corporate earnings. These factors will decide whether record highs can hold or face pressure. For now, momentum favors leaders, but discipline matters more than excitement.

Frequently Asked Questions (FAQs)

Why did the S&P 500 hit a record high today?

On December 23, 2025, the S&P 500 reached a record as large AI and technology stocks rose, helping the index climb despite strong economic data and rate concerns.

Are AI stocks still driving the stock market rally?

Yes. In late December 2025, AI-related stocks continue to lead market gains as investors expect long-term growth from artificial intelligence and cloud technology demand.

Why did small-cap stocks fall when the market rose?

On December 23, 2025, small-cap stocks fell because investors preferred large companies, which are seen as safer during periods of high interest rates and economic uncertainty.

Disclaimer: