- Meyka AI's Newsletter

- Posts

- Tesla Doubles Down as Markets Lift: Tech, Trends, and Tomorrow

Tesla Doubles Down as Markets Lift: Tech, Trends, and Tomorrow

A bold look at Tesla’s next big moves

Tesla is stepping into a new phase as global markets show a strong recovery in late November 2025. Investors are watching the company closely because Tesla often acts as a trend-setter for the entire tech and EV sector. The market lift is not random. It follows months of steady economic data, easing inflation, and growing demand for advanced technology. These forces are helping big tech stocks rise again, and Tesla is moving fast to take advantage of this momentum.

The company is doubling down on the areas that define its future. New vehicle updates, stronger AI tools, and bold factory expansion plans show that Tesla is focused on long-term growth. At the same time, the global EV landscape is changing quickly. More competitors are entering the market, but Tesla still holds a strong position due to its scale, brand, and innovation speed.

This newsletter explores how Tesla is using today’s market strength to build tomorrow’s breakthroughs. It also looks at the trends, risks, and opportunities that will shape the company’s next chapter.

Market Context: Why Tesla Is Rising Now?

Recent strength in global tech markets has helped revive interest in electric vehicles (EVs) and related companies. The tech rally is driven by renewed investor confidence in artificial intelligence and high-growth technology firms.

In this environment, Tesla stands at a strong vantage. The company blends hardware (cars, batteries) with advanced software (self-driving, AI, robotics). That mix appeals more now than ever.

Tesla’s ability to pivot between manufacturing and tech innovation helps it ride broader market waves. As banks, analysts, and investors lean toward companies that promise long-term growth, not just short-term profits, Tesla fits the narrative.

Tesla’s Big Moves: What the Company Is Doubling Down On?

Vehicle Innovation & New Models

In early 2025, Tesla rolled out a refreshed version of the Model Y. Changes include a sleeker nose, a full-width light bar, redesigned wheels, and updated cabin features like a larger touchscreen and ambient lighting.

In November 2025, Tesla also launched a Long Range, five-seat Model Y variant in China with an impressive CLTC range of 821 km. It runs on a 78.4 kWh battery, does 0-100 km/h in 5.6 seconds, and clocks a top speed of 201 km/h.

This launch shows Tesla’s aim to keep its product line fresh and competitive, especially in price-sensitive and fast-growing EV markets like China.

AI and Autonomous Tech

Tesla is pushing deeper into autonomy and robotics. The company recently announced plans for a new facility in Texas for robot (humanoid) production, the so-called “Optimus” line, with full operations slated for later.

Tesla’s autonomous ride-hailing service, Tesla Robotaxi, began limited deployment in Austin, Texas, in June 2025. This is part of a bigger push: Tesla wants to build a self-driving, ride-hailing network that does not rely on individual ownership. If successful, it could transform how people view mobility.

Manufacturing & Efficiency Upgrades

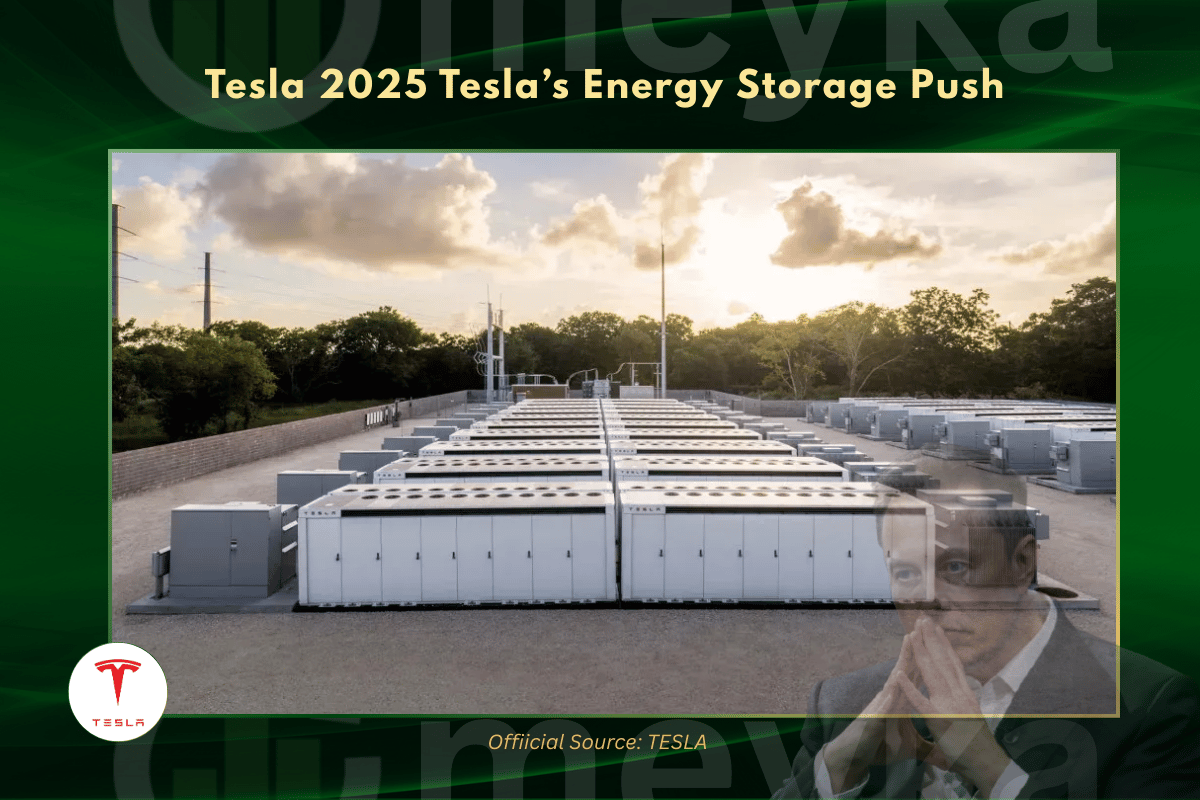

Tesla is expanding its manufacturing reach. A new mega-factory near Houston, Texas, is under construction and will focus on producing energy storage solutions alongside traditional EVs. This expansion reflects Tesla’s strategy to diversify beyond cars: energy storage and infrastructure may become key revenue sources not only from vehicle sales.

In addition, the firm claims a breakthrough in battery technology: a “Tera-Cell” battery with 40% higher energy density and over 600-mile range. That kind of jump could set Tesla far ahead in battery performance.

Financial Snapshot: What Investors Need to Know?

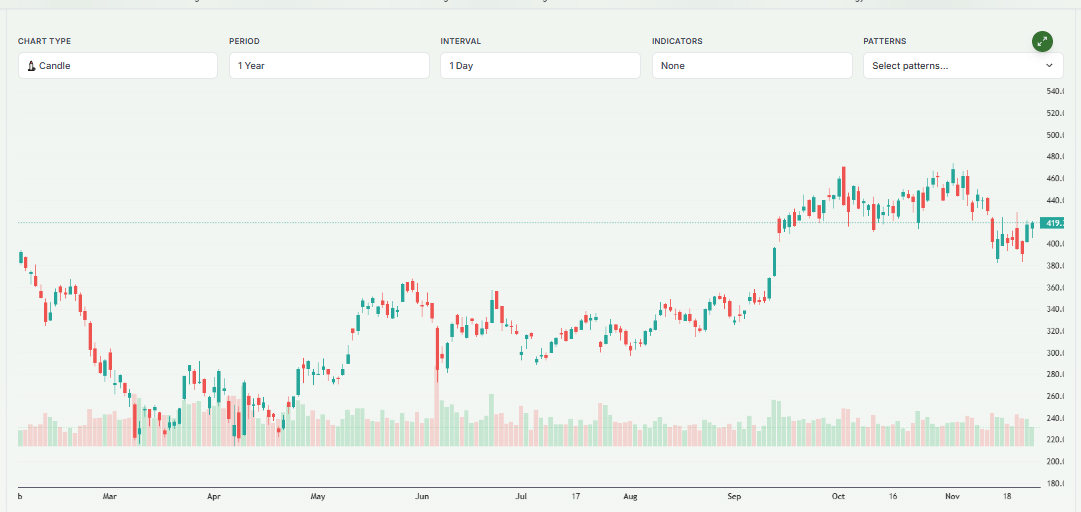

Tesla’s share price has gained traction in 2025. As of mid-November, the stock rose about 23-24% year-to-date, putting it back in positive territory for the year.

Meyka AI: Tesla, Inc. (TSLA) Year-to-Date Stock Overview

Still, gains are uneven. According to recent data, Tesla’s stock price reacted positively to AI-linked optimism, but was followed by caution from analysts concerned about overvaluation.

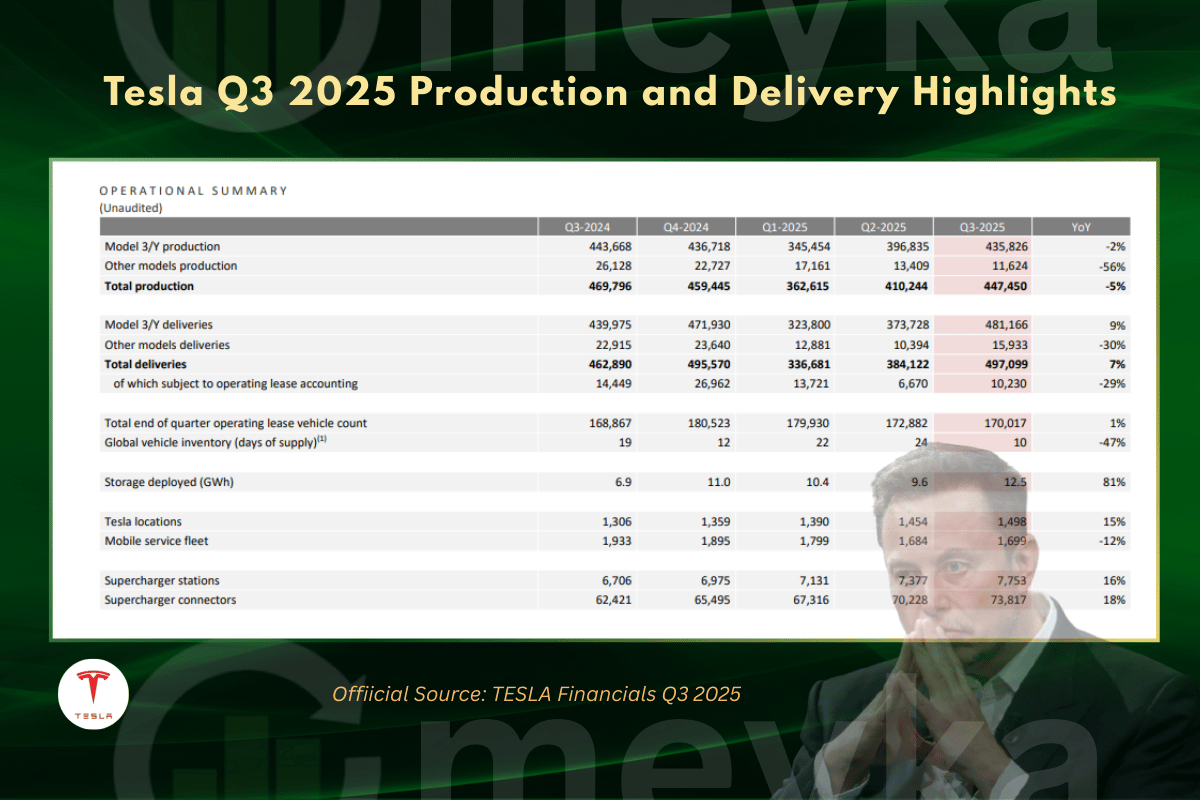

On the production front, Q3 2025 saw strong numbers: roughly 447,450 vehicles manufactured and 497,099 delivered, plus 12.5 GWh of energy storage deployed.

Even with that, full-year projections suggest deliveries may slip. Some analysts expect 2025 deliveries around 1.6 million, which would be 10% lower than 2024, indicating demand and pricing pressures remain a concern.

The takeaway: Tesla’s recent rebound is as much about promise and ambition as about current volume. Short-term challenges exist, but the long-term story, if executed, could still be powerful.

Global Strategy: Tesla’s Moves Around the World

Tesla appears to aim for global scale. It has started a factory expansion program in Texas for energy products. Meanwhile, Tesla hints at further global factories. Reports suggest possible future facilities in Mexico, India, and the Netherlands. This ambition reflects a strategy of being ready for global demand and also hedging against trade tariffs. Locally built cars or batteries reduce exposure to import taxes and supply chain risks.

At the same time, Tesla pushes to bring its autonomous-robotics vision to a global audience, not just a North American one. If the Robotaxi and Optimus plans scale, Tesla could operate across continents.

Big Trends Shaping Tesla’s Tomorrow

EV Market Evolution

Global sales of EVs continue to rise. According to recent data, more than 20% of new cars sold worldwide are electric.

But the competitive landscape is tougher. Cheaper EVs from other manufacturers, often supported by lower-cost supply chains, are challenging Tesla’s premium-brand position. This makes Tesla’s ongoing efforts to innovate and lower costs vital.

Energy & Storage Expansion

Tesla’s push into energy storage is real. The planned Houston facility and new “Megapack 3” and even larger “Megablock” battery bundles could add a major revenue stream.

As the world shifts toward renewable energy, demand for large-scale storage for homes, utilities, and even national grids may skyrocket. Tesla could become as much an energy-infrastructure company as an automaker.

Tech Convergence: AI, Robotics, Mobility

Tesla no longer sells just cars. It markets a future where mobility, AI, robotics, and energy storage converge all under one roof. This aligns with broader trends in technology and sustainability.

If Tesla can deliver on Robotaxi and Optimus promises, it could pivot from carmaker to a full-fledged tech-mobility company. Analysts calling it “the most undervalued AI name in the market” suggest the potential is visible.

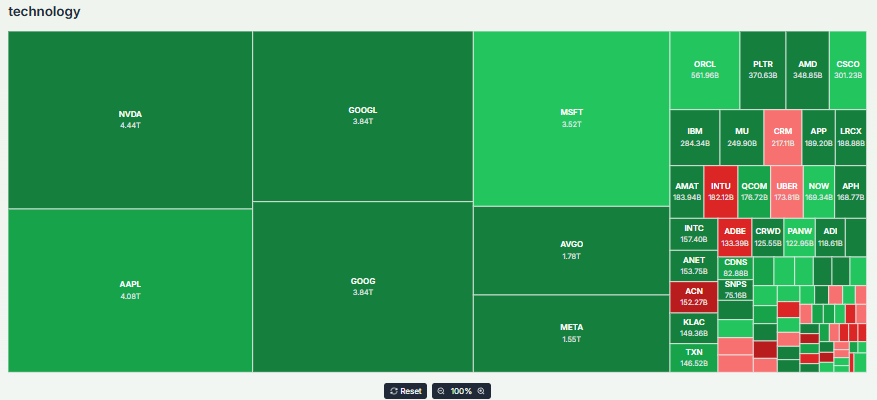

Tech Sector Recent Performance

In late November 2025, the tech sector showed strong but uneven performance, led by AI, cloud computing, and semiconductor demand. NVIDIA saw a surge in datacenter revenue, though its stock dipped amid competition from Google’s AI chip offerings.

AMD gained early in November on strong data‑center and AI chip demand but faced pressure as rivals entered the market. Alphabet (Google) rose with its new AI model and expanded AI infrastructure, boosting investor confidence in the sector.

Meyka AI: Technology Sector Current Performance Overview

Overall, the rally reflects growing interest in AI-driven technologies, while selective volatility reminds investors to focus on sustainable growth and real revenue, not just hype.

Tesla, the EV Giant: What to Watch Next?

In the coming months, several signals merit close attention:

New Tesla model announcements: updates to the Model 3, Model Y, and perhaps a new lower-cost EV for mass-market adoption.

Battery breakthroughs: Any progress toward the “Tera-Cell” or Megapack lineup could tilt the energy and EV markets.

Regulatory developments for self-driving: approvals (or delays) for FSD and Robotaxi in new jurisdictions will impact Tesla’s rollout speed.

Global demand and competition: how Tesla fares against cheaper EV brands, especially in China, Europe, and Asia.

Energy-storage demand: growth in renewable energy adoption may boost Tesla’s battery-and-storage business.

Wrap Up

Tesla is navigating a complex but promising landscape in late 2025. The company’s blend of hardware, software, energy, and robotics sets it apart.

Short-term challenges, including demand softness, pricing pressure, and steep competition, are real. But Tesla’s long-term vision remains bold. The company could evolve into a tech-mobility-energy powerhouse.

If its recent moves succeed, Tesla’s next chapter may look very different from its first: more than just cars, but a whole ecosystem.

Frequently Asked Questions (FAQs)

Why is Tesla stock rising in late 2025?

Tesla stock is rising because tech markets improved in November 2025. The company also shared new AI plans and updated cars, which increased investor interest during the month.

What new Tesla models or features were launched in 2025?

In 2025, Tesla released a refreshed Model Y with better range and design. The company also expanded early Robotaxi tests and improved battery tech to support future growth.

Is Tesla a good investment for 2026?

Tesla’s outlook for 2026 is mixed. Demand and competition are challenges, but new AI tools, stronger batteries, and energy projects may support long-term growth for patient investors.

Disclaimer: