- Meyka AI's Newsletter

- Posts

- Wall Street Futures Drop as Pinterest Tanks, AMD Slides, Rivian Defies the Trend

Wall Street Futures Drop as Pinterest Tanks, AMD Slides, Rivian Defies the Trend

Investors brace for a choppy session with tech under fire and auto names like Rivian delivering rare upside surprises.

Wall Street futures slipped early Wednesday, November 5, 2025, as traders faced a rough start to the midweek session. Tech stocks were under pressure again, pulling the broader market lower. Pinterest dropped sharply after missing user growth targets, while AMD slid as chip demand slowed across the sector. The sell-off added to recent worries that tech’s big rally may be losing steam.

Yet, it wasn’t all red on the screen. Rivian surprised investors with stronger results and upbeat production guidance, sending its shares higher. That rare green spot in the auto space gave traders a reason to stay alert instead of walking away from risk completely.

Investors are getting ready for a rough trading day, as weak tech stocks clash with some strength in car and energy companies. With earnings season in full swing and rate concerns still alive, markets seem trapped between fear and cautious optimism, a mix that promises more twists ahead.

Wall Street Futures in Focus

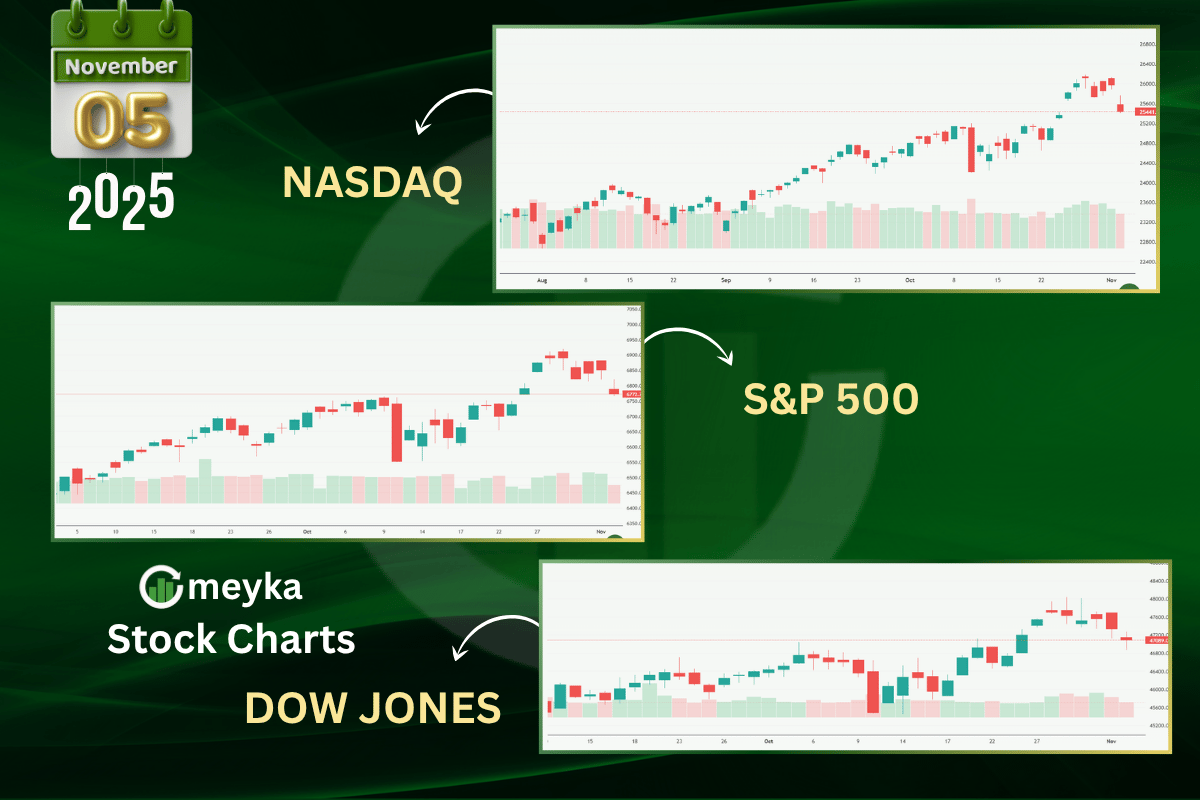

As of November 2025, S&P 500 futures were down before the open. They fell 10.25 points to 6,791.50. Nasdaq-100 futures slid 79.00 points to 25,496.25. Dow futures showed a small gain at 47,242.00, up 28.00 points. The mixed readout pointed to a choppy start. Traders parsed company reports and macro news. Volatility rose as earnings rolled in.

Tech Sector Takes a Hit

Tech names led to weakness. Pinterest tumbled after its third-quarter results missed the street on earnings and gave a cautious outlook for Q4. The company beat on user growth but guided below some forecasts. That gap hit investor confidence hard. Short-term sellers moved fast. Many ad-tech and digital media stocks pulled back with it.

Meyka AI: Pinterest Stock Price Overview

AMD also slipped on renewed worries about cyclical chip demand and a mixed reaction to its outlook. The company reported strong top-line trends but flagged areas that may slow next quarter. Traders translated that into a pullback in chip names and the SOX index. Sentiment in semiconductors is fragile now.

Meyka AI: AMD Current Stock Price Overview

Analysts noted that ad spending softness and a cooling cycle for some enterprise spending are key themes. That changed the tone on growth stocks. An AI stock research analysis tool highlighted valuation risks in ad-heavy platforms and cyclical chip exposure. The tool’s signals added to short-term selling pressure.

Rivian Defies the Trend

Rivian bucked the selling. The EV maker reported revenue and deliveries that beat forecasts. Revenue rose sharply year-over-year, driven in part by a rush to capture expiring EV tax credits. The company sold over 13,200 vehicles in Q3, and automotive revenue climbed markedly. Investors rewarded the results with after-hours gains. The move underscored that pockets of strength still exist, even when tech is weak.

Rivian’s margin progress and the growth in software and services also caught attention. Those gains point to a gradual shift from pure hardware sales to higher-margin offerings. That narrative helped shares outperform many peers on the day.

Broader Market Sentiment

The mood on Wall Street turned cautious as of November 4-5, 2025. Top executives warned a market drop of 10-20% is possible in the next 12-24 months. Many funds are trimming risk. They are lowering bets on high-beta stocks and increasing cash cushions. Survey data show rising ETF flows into energy, utilities, and defensive sectors.

Bond yields and a stronger dollar are adding to worries. With interest-rate uncertainty front and center, investors are watching every move from the Federal Reserve for clues.

Funds are also rotating out of richly priced growth names and moving into areas with clearer earnings power. The “safe-haven” shift reflects concern that the recent tech-led rally may have gotten ahead of itself. Valuations remain high, and concentration risk is elevated.

In short, the market is looking for stability. Risk is still there, and many are shifting to less volatile options until clearer signals emerge.

Sector Highlights Beyond Tech

Energy names gained some ground on steady oil prices. Financials were mixed as traders weighed rate expectations and bank reports. Consumer discretionary lagged, where retailers signaled softer ad spend. Small caps showed uneven action; some beat-and-raise stories held up while others sank with the broader retreat. Market breadth narrowed as decliners outnumbered advancers in early trading.

Global Market Impact

Meyka AI: Japan’s Nikkei 225 Index Price Overview

Markets in Europe and Asia were hit after the U.S. tech slide. On November 5, 2025, Japan’s Nikkei 225 fell about 2.8%, while South Korea’s Kospi Index dropped up to 6.2%.

In Europe, the STOXX 600 slid around 1.4% to its lowest level in over two weeks, as investors adopted a risk-off stance. The sell-off spread globally because many markets are tied to U.S. tech and chip companies.

Meyka AI: STOXX Europe 600 Index Price Overview

The drops in Asian chip-heavy markets of South Korea and Taiwan accentuated the ripple effect. Currency and bond markets also felt the impact. The stronger U.S. dollar and rising yields added pressure on emerging-market flows and global risk appetite.

What to Watch Next?

Watch the rest of the earnings. Major tech reports will shape the tone for days. Tracking guidance beats and misses is crucial. Also watch U.S. economic releases and any Fed-adjacent speeches. Those items can swing rates and risk appetite fast. Traders should note forward guidance from advertisers and chipmakers. That guidance often foreshadows the next leg for markets.

Final Words

The market opened Nov. 5, 2025, in a fragile mood. Tech results drove much of the action. Pinterest’s miss and AMD’s cautious signals pressured futures. Rivian offered a notable exception. The day looked set for choppy trading as investors balanced profit-taking with selective buying. Follow-through in earnings and any fresh macro clues will determine if the pullback deepens or fades.

Frequently Asked Questions (FAQs)

Why did Wall Street futures drop today?

Wall Street futures dropped on November 5, 2025, because weak tech earnings and investor worries about interest rates made traders cautious and pulled markets lower.

What caused Pinterest and AMD stocks to fall on November 5, 2025?

Pinterest and AMD stocks fell on November 5, 2025, after both reported mixed earnings and gave weaker outlooks, raising fears about slowing growth in tech.

Why is Rivian stock rising while tech stocks are falling?

Rivian stock rose on November 5, 2025, after strong earnings and higher deliveries showed solid demand, giving investors hope even as most tech shares declined.

Disclaimer: